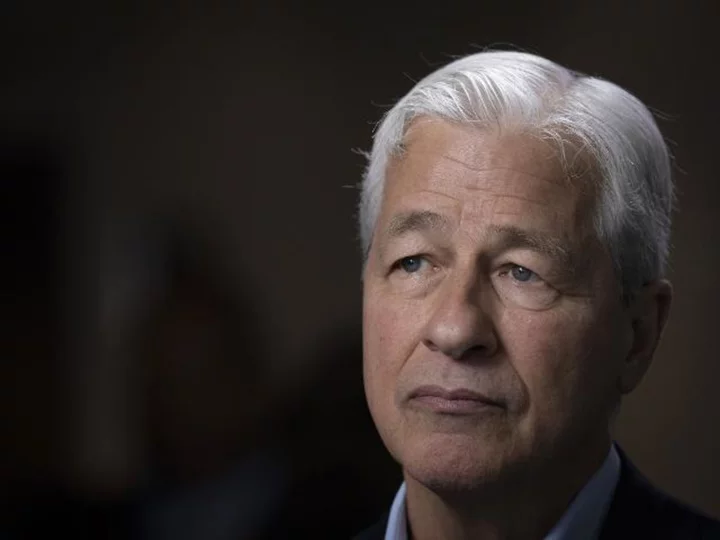

In a lawsuit over the role JPMorgan Chase played in longtime client Jeffrey Epstein's sex trafficking crimes, attorneys for an anonymous Epstein victim have asked a federal judge to allow them to question JPMC CEO Jamie Dimon and other bank personnel for a second time.

Attorneys for the woman who's suing the bank for allegedly enabling and benefiting from Epstein's criminal activities claim they should be permitted to recall Dimon and others for depositions based on information in documents turned over late by the bank.

The plaintiff's filing accuses JPMorgan of intentionally slow-walking its document production to avoid questioning on certain topics during depositions that occurred over the last few months.

"Despite the Court's clear warning, JPMC still failed to expeditiously produce documents from the custodial files of key witnesses, some of whom had already been deposed, for strategic reasons," the filing docketed Friday says. "JPMC strategically withheld it from Plaintiff until she could no longer make meaningful use of it in examining JPMC's employee."

Dimon sat for a deposition Friday May 26, CNN previously reported.

The plaintiff attorneys want to ask Dimon about an extensive JPMC internal review related to Epstein conducted in the fall of 2019. The financial institution produced "key documents" related to that review days after Dimon's deposition, according to the motion.

"These documents demonstrate that JPMC was fully capable of learning the full extent of Epstein and Staley's personal relationship," the filing says. "And yet waited to do so until 2019 despite the myriad red flags and public reports about Epstein's conduct over the years."

Dimon testified he did not know who Jeffrey Epstein was or that he was a client of the bank until 2019, and that he would have directed JPMC's general counsel to conduct an investigation after learning that a client of the bank had been engaged in sex trafficking, according to the filing and a deposition transcript obtained by CNN.

CNN has reached out to JPMorgan Chase for comment.