As Middle Eastern sovereign wealth funds emerge as the go-to investors for some of the biggest deals, the world’s oldest and one of its largest is being eclipsed by its more ambitious, flashier neighbors.

The Kuwait Investment Authority, which manages the Gulf country’s $700 billion sovereign wealth fund, has lost several senior managers, including heads of key divisions over the past year, according to people with knowledge of the matter. It’s still to appoint successors for some of those positions, they said.

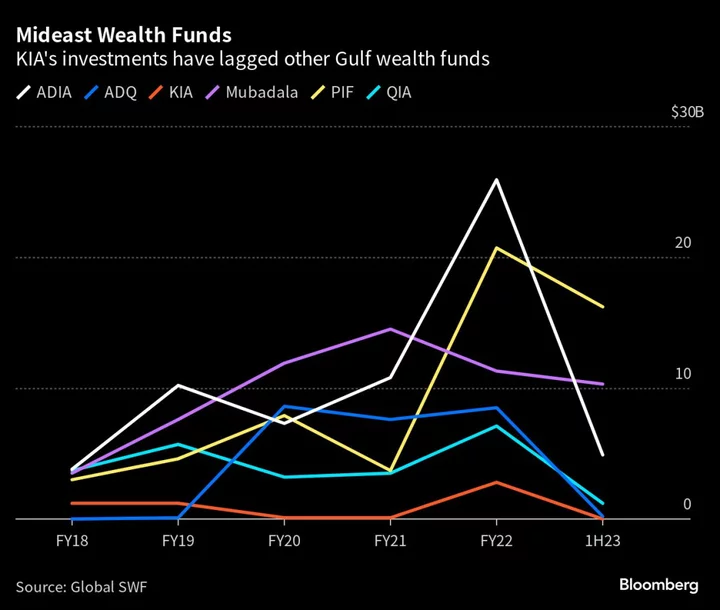

The KIA invested just $2.8 billion last year, compared with $25.9 billion by the Abu Dhabi Investment Authority and $20.7 billion by Saudi Arabia’s Public Investment Fund, according to boutique adviser and data firm Global SWF. While the funds’ often-secretive transactions can be hard to track with precision, similar estimates from Javier Capapé, who specializes in sovereign entities at Spain-based IE University, confirm the trend.

The KIA’s challenges are symptomatic of a broader malaise across Kuwait, battered by five changes of government in a year. There have been a series of investigations into the fund’s investments, and people familiar with the matter described increasing interference from ministers in its decision making. While it’s still making investments, a lack of direction and fear of scrutiny by lawmakers has caused a degree of paralysis at the fund on forging deals, the people said.

“Considering the size of its balance sheet and its long history as a global investor, KIA has been losing momentum against other regional SWFs that are more stable and active,” said Diego Lopez, managing director of Global SWF. “One of the key reasons is the numerous political changes that Kuwait has gone through recently, which have affected the board and the executive leadership of both the KIA and the Public Institution for Social Security.” The PIFSS is Kuwait’s public pension fund, whose top leaders were removed last year and still haven’t been replaced.

Many of the world’s dealmakers are turning to the region’s sovereign entities, who collectively control at least $3 trillion of assets, to be a leading source of funding as others retreat. In recent months, the likes of the $700 billion PIF and $276 billion Mubadala Investment Co. have done deals in everything from aviation to tourism, sports to video games. Neither Global SWF nor IE University are aware of any deals done by the KIA this year.

KIA officials couldn’t be reached for comment. Still, people familiar with the fund’s strategy say its existing investments have been doing well and that it prefers to remain low-key and conservative. The Future Generations Fund, the wealth fund managed by the KIA, reported returns of 33% for the year ended March 2021, the most recent publicly available data. This included a 38% return from the KIA’s London arm, the Kuwait Investment Office.

Prolific Investor

The dearth of prominent deals marks a dramatic about-turn for the fund, which was once among the region’s most active. Until recently, the KIA was a leading global investor, with holdings in BlackRock Inc. and Mercedes-Benz Group AG. During the 2008 crisis, it bought into banks including Citigroup Inc. It had high profile successes in the past, selling its stake in Citigroup in 2009 for $4.1 billion, at a profit of more than $1 billion. The Kuwait Investment Office has also been a prolific investor, and participated in the US listing of private equity firm TPG Inc.

The KIA doesn’t officially disclose the value of its assets or details of its investment strategy. Data and interviews show that the fund’s activity has been up and down in recent years rather than totally absent, yet it remains lackluster compared with regional rivals.

Global SWF estimates that the $2.8 billion invested by the KIA in 2022, was up from $100 million a year earlier. Research from IE University shows the KIA invested $670 million in 2021 and $4.4 billion last year, mostly due to its participation in a $3.6 billion deal for US ports logistics company Direct ChassisLink Inc. That deal was done with other investors and is one of the last known major purchases it’s been publicly involved in.

Political Upheaval

For more than two years, Kuwait — well known for its deep domestic frictions and frequent elections — has gone through major political upheaval. Its top leadership changed after Emir Sheikh Nawaf Al-Ahmed Al-Sabah succeeded his half brother, who’d been in power for decades. Since then, there’s been a broad shake-up of major government entities. In June, the country appointed its fifth government in less than a year.

“The weaknesses of Kuwait’s economy and the political constraints on economic policymaking certainly create some negative spillovers to perceptions of the KIA,” said Robert Mogielnicki, a senior resident scholar at the Arab Gulf States Institute in Washington. “You don’t have this sense that KIA is participating in and benefitting from a virtuous cycle of economic momentum within Kuwait.”

The Kuwait Investment Board was established in London in 1953, eight years before the nation gained independence, to invest surplus oil revenue and help diversify the economy. The board was later replaced by the Kuwait Investment Office, and in 1982 the KIA was set up as its parent entity. The KIA also manages the General Reserve Fund, or treasury.

The fund was thrust into the global spotlight last summer when it abruptly ousted the head of the KIO, Saleh Al-Ateeqi. Almost a year on, Al-Ateeqi’s position hasn’t been filled, and the KIO — which mainly invests directly in public equities and fixed income — is largely being managed from Kuwait. There have been a number of departures from the London branch in recent months and it’s also struggled to recruit talent, the people said.

Since the start of the pandemic, most of the KIA’s investments have been by its subsidiaries in infrastructure, small investments in IPOs or listed companies and commitments to existing fund managers, such as Invesco Ltd., BlackRock and Northern Trust Corp., according to Global SWF’s Lopez.

Over the past three years, the KIA has been more focused on selling assets rather than acquiring them. It has offloaded holdings in companies such as Viesgo in Spain, Rialto and Transgrid in Australia and Thames Water in the UK, according to Lopez.

In March, it sold about €1.4 billion worth of shares in Mercedes-Benz after holding them since 1974. People with knowledge of the matter also described internal tensions over some investment decisions.

The fund said the Mercedes-Benz sale was part of an effort to diversify its portfolio. Still, there were some who were perplexed by the decision and the timing of the sale, the people said.

The appointment last month of Saad Al-Barrak as state minister for economic and investment affairs, and oil minister, places him as chairman of the KIA, according to the website. It’s a departure from previous years when the fund was historically managed by the finance minister. While Al-Barrak could shake things up, Mogielnicki isn’t so sure.

“I don’t see a radical shift in investment approach and priorities happening overnight,” Mogielnicki said.

--With assistance from Ben Bartenstein.

Author: Fiona MacDonald, Archana Narayanan and Nicolas Parasie