Japanese companies may struggle to meet rising expectations from global institutional investors amid change in board diversity standards, according to the latest report on Japanese corporates by MSCI ESG Research.

Just one-tenth of MSCI Japan Index firms have reached the 30% female board member threshold that the government is seeking for top-listed businesses, according to Moeko Porter, the author of the report.

That 30% level is already lower than the 40% target set by European peers, and the current situation could hinder Japan’s ambition to improve its standing as a global financial hub, she added.

“While we are seeing gender diversity improving, there’s still obvious concern that the rate of improvement needs to catch up with what might be expected of them,” the vice president at MSCI ESG & Climate Research told Bloomberg in an interview last week.

Porter’s comments came after Japan’s latest annual general meeting season demonstrated that pressure from institutional investors is already driving change, and shareholders are likely to push firms toward further change.

Investors have become more critical of Japan’s remaining all-male boards, and seven companies within the MSCI index added a female director to their board lineup for the first time this year, according to Porter’s report.

In a clear example of pressure on one of Japan Inc.’s largest firms, support for Canon Inc. CEO Fujio Mitarai dropped to 50.6% from 75.3% at the company’s March shareholder meeting, largely due to the board’s lack of diversity.

“This year’s proxy season shows that the lack of gender diversity can lead to investor discontent,” said Porter, who was also a researcher at proxy advisor Glass Lewis & Co. in the past. “A decade ago when I started covering corporate governance in Japan, it was unthinkable for a management proposal to fail or for a shareholder proposal to pass.”

But things have changed. Increased investor scrutiny has now shifted to more concrete actions for voting against all-male boards, and pushing companies to be more open about what efforts they are making toward diversity, she added.

Institutional investors including Norway’s pension fund, BlackRock Inc. and Goldman Sachs Asset Management have already set rules to vote against Japanese firms with few or no female board members. Domestic institutional investors such as Sumitomo Mitsui Trust Asset Management and Nomura Asset Management are also following suit.

Yet growing pressure from investors may out pace current efforts to increase the female talent pipeline in Japan. Compared to their male counterparts, female board members in the country are far more likely to hold seats at multiple firms, due to a perceived lack of talent that can fill those roles.

Porter said that the mindset of looking for candidates with in-depth industry knowledge or understanding of the business “could create missed opportunities.” Instead, firms need to think beyond existing skill sets in the board, she said.

In addition to the higher bar for gender diversity, overseas investors might look to the governance risk associated with long-tenured and aging directors, Porter’s report showed.

Companies should start with broadening their search for more diverse board members, focusing on identifying skills and expertise that could compliment the current board, and leveraging third-party agencies that provide board candidate training and matching, Porter said.

Latest Numbers

The number of seats held by women on the boards of companies in the Nikkei 225 Index remains unchanged in the third quarter from the previous three-month period, according to data compiled by Bloomberg. The average number of female directors was unchanged at 1.7, out of an average board size of 10.4.

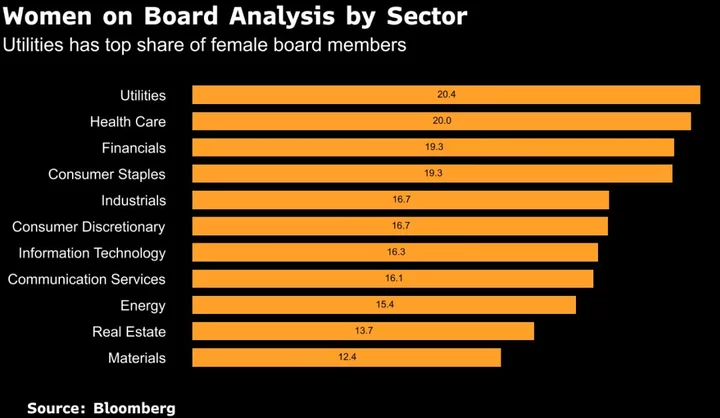

- The percentage of female directorships was unchanged at 16.7%

- That is below the 37.1% of women on boards of the S&P/ASX 200 in Australia, 33.4% of the S&P 500 in the U.S., 40% of the Stoxx 600 in Europe and 19.4% of the Hang Seng in Asia

- Nidec Corp. has the highest percentage of women on its board

- There are 13 Nikkei 225 companies above the key threshold of 30% female board membership

- Six companies, including Canon Inc., Suzuki Motor Corp. and Nexon Co., do not have any female board members

- The Bloomberg Gender-Equality Index returned -2.9% in the third quarter, outperforming the MSCI World Index, which returned -3.4%

Nikkei 225 companies with the highest and lowest percentage of female board members:

The Bloomberg Gender-Equality Index is a modified capitalization-weighted index that tracks the financial performance of those companies committed to supporting gender equality through policy development, representation and transparency.

--With assistance from Akemi Terukina.