Shares in Italian banks gained after the government tweaked a proposed windfall tax, giving lenders a chance to avoid paying if they set aside additional capital reserves.

Italian banks are the best performers among the 44-member STOXX Europe 600 Banks index. Banco BPM SpA is leading gains with a 3.8% increase as of 9:30 am, BPER Banca SpA is up 3,2%, and Intesa Sanpaolo SpA and UniCredit Spa are up more than 1%.

Lenders can opt out of the tax if they allocate 2.5 times the amount owed to strengthening their common equity tier 1 ratio as non-available reserves, according to an amendment to the law, which is currently undergoing parliamentary approval. If those reserves are later distributed as dividends, banks will have to pay the full tax plus matured interest, an amendment seen by Bloomberg News says.

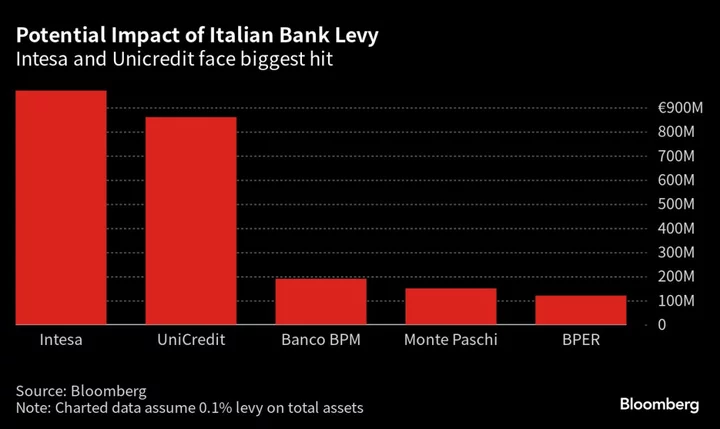

The amendment also caps the tax at 0.26% of lenders’ risk-weighted assets on an individual basis instead of 0.1% of their total assets.

“The revision implies that for most banks the impact is a touch lower compared to previous calculations,” Marco Nicolai, an analyst at Jefferies, wrote in a report Monday.

Given the abundant excess of capital and the banks’ willingness to give high returns to shareholders, “we do not expect the majority of the listed Italian banks to opt for the capital strengthening,” said Luigi Tramontana, an analyst at Banca Akros.

The changes, which are widely expected to be approved by parliament and become binding this week, signal a compromise from the right-wing government of Giorgia Meloni following a slump in Italian bank stocks and criticism from the European Central Bank. The levy, which took aim at profits pouring in from higher interest rates, also caused a split in the ruling coalition, drawing opposition from junior partner Forza Italia.

The levy will apply to 40% of banks’ extra profits measured by the difference in net interest income between 2023 and 2021 above a 10% gain. The new draft has been calculated to generate the same amount of income for the government as the original version of the tax, according to the amendment.

The amendment does not give a figure for how much the government expects from the tax. Meloni said earlier this month that even if the levy is modified, the state will still expect inflows of almost €3 billion ($3.2 billion). Deputy Premier Antonio Tajani reiterated in an interview with RAI television Sunday that the amended version of the tax would affect inflows only marginally at most.

The amended levy will protect savings and market stability and create more credit for families and businesses, Tajani wrote late Saturday on X.

It’s positive that the tweaked law includes the possibility of opting for strengthening capital instead of paying the tax, even if it’s still unclear how it will be applied, Nicola Calabrò, Chief Executive Officer of Cassa di Risparmio di Bolzano-Sparkasse, said in an interview with Corriere della Sera on Sunday.

--With assistance from Tommaso Ebhardt.

(Updates with market reaction, analysts from first paragraph)

Author: Sonia Sirletti, Daniele Lepido and Alessandra Migliaccio