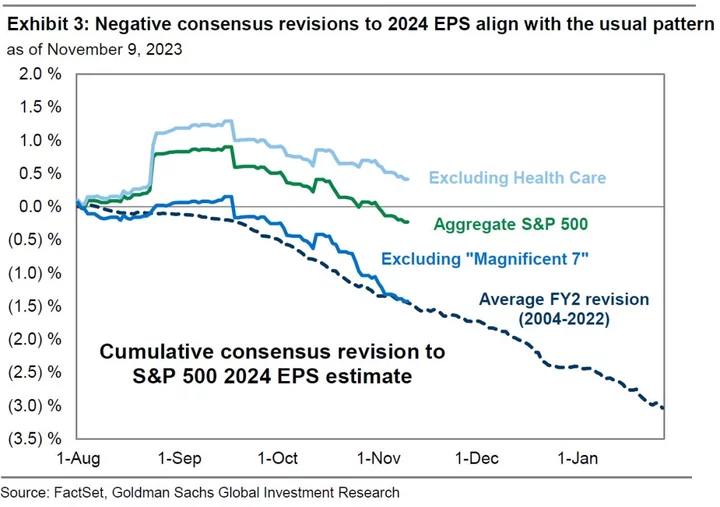

Investors are overly concerned about the weakening outlook for US corporate earnings, which so far merely track a historical pattern, according to Goldman Sachs Group Inc. strategists.

Estimates for fourth quarter profits have dropped by 4% since the start of October and are setting a low bar for S&P 500 companies, David Kostin and his colleagues wrote. Expectations for 2024 are also following a typical pattern and only dipped 0.4% once health care — the significant drag — is excluded, they said.

Since 2004, quarterly earnings per share estimates typically decline by 6% in the months leading up to the start of earnings season, the strategists wrote, adding that investors have communicated anxiety about the negative consensus earnings revisions.

“Many investors are concerned about downgrades to consensus earnings forecasts, but they are tracking in line with the typical pattern and are being dragged down by Health Care,” they wrote in the note dated Nov. 10.

Their outlook comes as the third-quarter earnings season nears a close, with over 80% of S&P 500 companies beating estimates. The strategists said the S&P 500 firms’ earnings climbed 4% from a year ago after analysts were expecting 0% growth heading into the reporting period.

The strategists expect S&P 500 earnings-per-share to rise 5% in 2024 to $237, which is above the median top-down strategist forecast of $230. Morgan Stanley analysts also forecast a profit bounce next year, with earnings-per-share growth coming at $229.