International Business Machines Corp. is prioritizing helping Japan’s chipmaking startup Rapidus Corp., with a senior executive describing the budding foundry business as vital to securing long-term global supply.

Rapidus, a venture backed by some of Japan’s biggest electronics firms, is turning IBM’s 2-nanometer chip design into production-ready silicon and aims to fabricate such chips at scale in the latter half of this decade. The most advanced semiconductors today are built at the larger 3nm node.

“When it comes to 2nm technology, we are focusing our efforts on Rapidus and investing a great deal of resources to this project, even sacrificing some capacity that we could have used in other research,” IBM Japan’s Chief Technology Officer Norishige Morimoto told Bloomberg News in an interview. “We want Rapidus to succeed. We want it to contribute to a stable supply of the chips we and the world need.”

Rapidus is a quasi-public project that got its start last year as a venture to build out Japan’s local chipmaking capacity at a time of rising geopolitical tensions and protectionism. It has the government’s support and is led by veterans of the semiconductor supply chain, including Tetsuro Higashi, the former chairman of Tokyo Electron Ltd., and Atsuyoshi Koike, the former Japan president of Western Digital Corp.

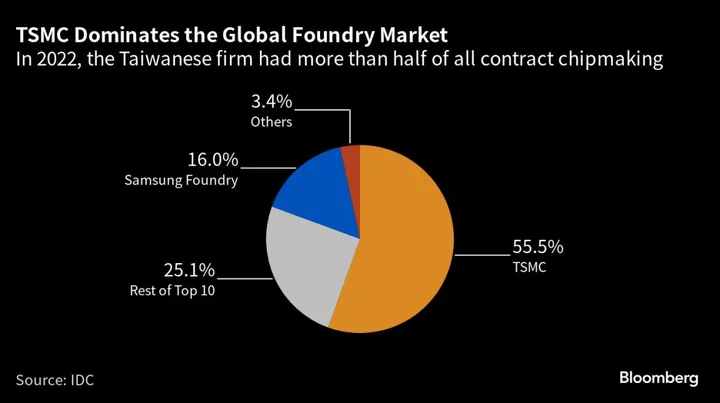

The daunting task ahead of them is to create a world-class chipmaking foundry — fabricating silicon for outside customers — to catch up with industry leader Taiwan Semiconductor Manufacturing Co. within a handful of years. The duo have drawn investment from companies including Toyota Motor Corp., Sony Group Corp. and Nippon Telegraph & Telephone Corp. Rapidus is working with IBM and Belgium-based microelectronics research hub IMEC.

Rapidus engineers have been dispatched to IBM’s Albany NanoTech Complex to design 2nm mass production lines while its factory is being built in Hokkaido, accelerating the development process. The Japanese firm expects to invest ¥5 trillion ($35 billion) in its 2nm project, roughly matching the annual outlay of TSMC and fellow leading chipmaker Samsung Electronics Co.

Read more: Chip Industry Veteran Aims to Help Japan Build Its Own TSMC

IBM would be open to helping Rapidus lock up further deals with major chip firms. “We won’t rule out any options as long as they match with our business needs,” Morimoto said. IBM also provides chipmaking technology to Samsung’s foundry division.

“Rapidus and Samsung are on the same platform as they both use IBM technology, and it’s very possible the two can strike a win-win partnership as their business models are quite different,” Omdia analyst Akira Minamikawa said.

Read more: Japan’s Rapidus Seeks Billions of Dollars to Reboot Chip Sector

IBM provides Rapidus key process technology that enables 2nm chip nodes and beyond, using a new type of transistor composition called nanosheet. Jumping forward to such advanced geometries is a huge leap from Japan’s existing capacity, which trades in more mature nodes like 40nm, but Morimoto is confident in the country’s deep roster of seasoned chip engineers.

Semiconductor demand is set to keep growing as a post-Covid recovery takes hold and the artificial intelligence boom drives the need for more memory and computing power.

Global revenue is expected to reach $1 trillion by 2030, doubling in the space of a decade, according to Inna Skvortsova, market analyst at industry body SEMI.

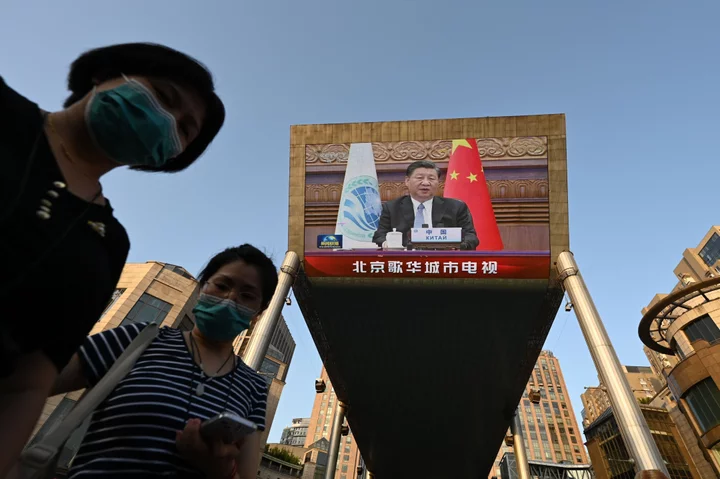

Presently, only Samsung and TSMC can produce the most advanced chips and there’s widespread interest — from Washington to Beijing and Brussels — in adding more redundancy to the sources of supply. Rapidus would ideally offer a third option and, moreover, should be welcomed by the industry leaders who have struggled to meet demand, Morimoto said.

“We know from our own experience that providing the newest generation of chips is not something that one company can handle alone,” he said. “Both TSMC and Samsung will welcome Rapidus joining the club of cutting-edge chip manufacturers because, as things stand now, they are making customers wait. Rapidus taking some orders from them wouldn’t be a problem.”

TSMC Chairman Mark Liu has said he doesn’t see Rapidus as a competitor, as the Japanese chipmaker will focus on fostering engineering talent.

--With assistance from Takahiko Hyuga and Debby Wu.