Goldman Sachs Group Inc. joined a list of brokers turning less bullish on Tesla Inc. shares after the electric-vehicle maker’s blistering rally this year.

The stock dropped 6.1% Monday after Goldman’s Mark Delaney downgraded his recommendation to neutral from buy, noting the substantial surge in the shares as well as price declines for new cars.

“The stock now better reflects our positive long-term view of the company’s growth potential and competitive positioning,” Delaney wrote in a note. “We are also cognizant of the difficult pricing environment for new vehicles.”

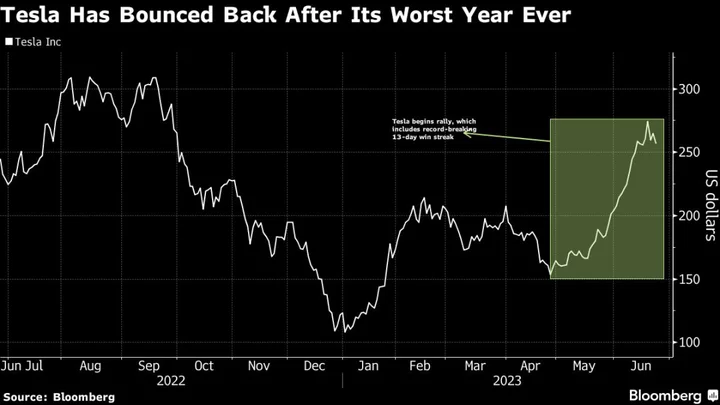

After Tesla’s biggest annual stock decline ever in 2022, the automaker’s shares have more than doubled this year to close Friday at $256.60, giving the company a market value of $813 billion. Just in the past month Tesla has gained 38%.

Last week, Wall Street warned that Tesla’s lightning-quick rally had started to show signs of unraveling, warning that investors were too optimistic about its artificial intelligence credentials and that the stock had become “overbought.”

Goldman’s downgrade is at least the fourth in the past week. Morgan Stanley, citing optimism related to AI taking the stock to “fair valuation,” cut Tesla to equal-weight. Barclays also cut the stock to equal-weight, saying it had rallied too far and too fast while questioning the near-term fundamentals of the company. DZ Bank AG, meanwhile, recommended investors sell the stock.

Analysts on average now expect the stock to drop 12% in the next 12 months, according to data compiled by Bloomberg. The Street has 20 buy ratings, 20 holds and 9 sells on Tesla, the data show.

Goldman’s Delaney had had a buy recommendation on Tesla since December 2020. The shares returned 35% over that period, compared with 23% for the S&P 500.

(Updates stock move at market close)