Goldman Sachs Group Inc. cut its target for the MSCI China Index on earnings and currency concerns, but maintained its overweight recommendation, saying investors’ fears have been priced in.

The bank lowered its target to 70 from 80 as it reduced its earnings estimates due to an uneven economic recovery and a stronger forecast for the greenback versus the yuan. The index closed at 58.80 Thursday, with the new target implying a 19% upside by March 2024.

“We continue to see a compelling risk/reward setup for Chinese stocks,” analysts including Kinger Lau wrote in a note Friday. “While we fully recognize the cyclical and structural growth and liquidity challenges facing China, we’d feel hard-pressed to surrender our constructive view” they added, citing valuations, bearish sentiment and light positioning.

Misery has spread in the Chinese stock market, with the Hang Seng China Enterprises Index falling into bear market territory this week. Investors are concerned about sluggish macro data, a weakening yuan, lingering geopolitical tensions and a lack of meaningful easing measures by policymakers.

MSCI China’s current valuation is close to pricing in a scenario where the Chinese economy only expands 5% this year and the world enters a mild recession, Goldman estimated.

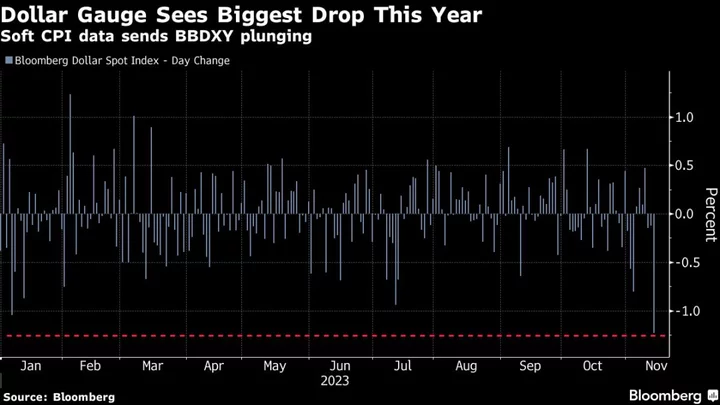

The index jumped as much as 3.5% on Friday as concerns eased over further Fed rate hikes.

China’s profit growth should be strong in the second quarter given the favorable base effect last year, which may help anchor investors’ growth expectations and reaffirm that the recovery is on track, Goldman said. Meanwhile, more monetary easing, such as cuts in the reserve requirement ratio, could be on the table, it said.

Traders More Comfortable With a Fed Pause as Key Jobs Data Looms

One key risk that Goldman highlighted is investor’s positioning in Chinese assets. US investors have “net sold about $40 billion of ADRs, but have net bought about $130 billion of H shares” since the peak of 2020, according to the bank.

“In sum, while positioning length and flows have weakened in the past months, one could argue that we are not yet at the trough of the positioning cycle,” the note added. “Hence more active selling could occur if sentiment toward China assets continues to falter.”

(Updates with MSCI China’s Friday move in sixth paragraph)