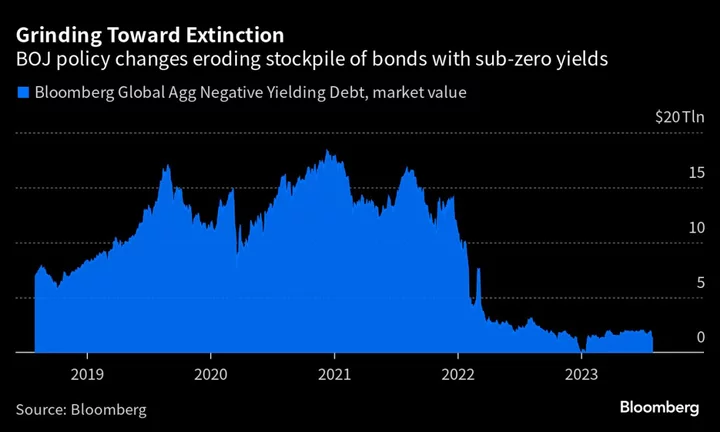

The world’s stockpile of negative-yielding debt looks to be grinding toward extinction as the Bank of Japan eases back on its rigid bond market control.

The global stock of bonds where investors receive sub-zero yields dropped to $1.3 trillion on Monday when two-year Japanese bond yields topped 0% for the first time since January. That’s the month when the pile disappeared for a single day.

The market value of negative-yield bonds in Bloomberg’s Global Aggregate Index of debt peaked at $18.4 trillion in late 2020 and has shrunk by more than $600 billion over the past three trading days. The BOJ moved to allow 10-year yields to go as high as 1%, spurring many investors to double down on bets the central bank is on the way to dismantling the world’s boldest experiment with ultra-loose monetary policy.

All 47 of the bonds in the Bloomberg global bond gauge that had negative yields on Monday are Japanese government notes, with the longest-dated of them maturing in June 2026.