By Howard Schneider

WASHINGTON (Reuters) -Rocketing U.S. government bond yields that have led to a global jump in borrowing costs are raising new risks for economic policymakers hoping to lower inflation without triggering a major crisis.

The world's finance officials, who will gather in Morocco this week for the annual meetings of the International Monetary Fund and World Bank, may disagree over the exact drivers of a global bond rout that now appears to reflect more than guessing how far central bankers will raise interest rates.

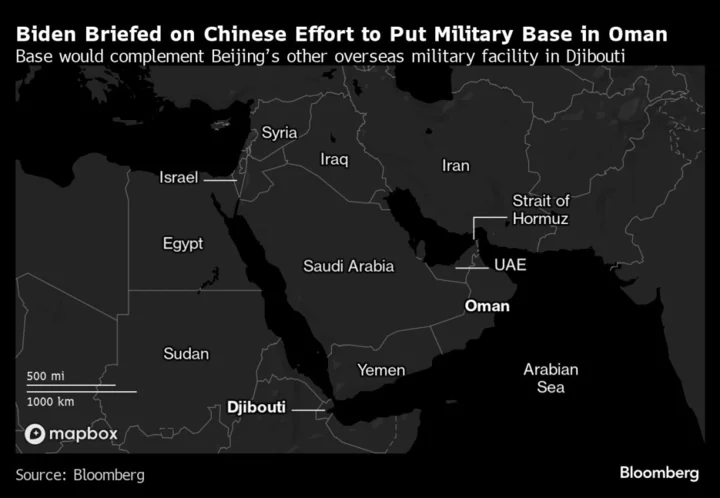

The cause - whether high government deficits, China's suddenly turgid economy, or political dysfunction in the U.S. Congress - may be less important, though, than the implications for a world financial system that had seemed headed for a "soft landing" from the post-pandemic breakout of inflation.

Central banks around the world approved rapid-fire interest rate increases in response to rising prices, and officials throughout the policy tightening welcomed the largely smooth adjustment in global financial conditions as a testament to better monetary and fiscal management across many countries.

But after what was deemed "a summer of resilience," Goldman Sachs economists said "cracks" are appearing as emerging market sovereign bonds come under pressure on the heels of rising yields on U.S. Treasuries, the world's risk-free benchmark that draws money from other investments as interest rates rise.

The yield on the 30-year U.S. Treasury bond last week pierced 5% for the first time since 2007. While it was routinely above that level through the first years of this century, analysts say the speed of its rise is noteworthy, particularly as it occurred even as the Federal Reserve and other central banks have signaled their own rate hikes are near an end.

"There should be concern less about the level and more about the pace of change," said Gene Tannuzzo, global head of fixed income at Columbia Threadneedle.

Long-term U.S. yields have climbed roughly 1 percentage point in the past three months compared with a single quarter-percentage-point Fed rate hike during that period. "That is a rate of change that cannot be sustained, and if we continue to move in that direction, then we would need to see action from the Fed" to blunt the impact, Tannuzzo said.

SPILLOVER RISK

The IMF and World Bank meetings are a chance to take stock of the state of the global economy, and are accompanied by signature reports on the world economic outlook and the state of global financial markets.

Inflation and the impact of tighter monetary policy have been focal points since prices began a sharp climb in 2021. The IMF's last Global Financial Stability Report, issued in April, showed risks to the financial system were top of mind after several high-profile U.S. bank failures in the prior month.

But that moment passed without any broader contagion, and the outlook turned steadily brighter from there, particularly in the U.S.: The prospect of continued economic growth alongside falling inflation - the so-called soft-landing scenario - went from a history-defying aspiration to, in effect, the Fed's baseline.

That sort of best-case outcome would have positive global repercussions. Keeping the world's largest economy out of recession provides steadier demand for other countries' exports, as well as more certainty as Fed rate hikes hit a stopping point.

The fast moves in financial markets, however, could prove destabilizing, with the impact felt through rising bond yields, a stronger dollar, and, if sustained, renewed inflation pressures in other countries.

"There are effects that could happen if you create budget strains in other countries or ultimately budget crises in other countries. I think that is something that the Fed needs to be watching," Karen Dynan, an economics professor at Harvard University, said during a recent presentation at the Peterson Institute for International Economics in Washington. "Those sorts of crises could spill over into broader financial markets and then pose a real threat to our economy."

Fed officials don't see that yet.

In comments last week, a number of Fed regional bank presidents saw the activity in the Treasuries market as in line with what would be expected from the central bank's rate increases, saying it has not had the sort of outsized impact on consumer or business spending that would warrant worrying whether policymakers had gone too far with the rate hikes.

UNANTICIPATED TIGHTENING

But the jump in yields also demonstrates some of the vagaries of central banking that officials are likely to try to puzzle through this week.

Global growth, particularly in light of China's current weakness, already is expected to slow. After the massive worldwide fiscal response to the coronavirus pandemic, many national budgets may be too stretched to respond forcefully to a currency crisis or financial instability sparked by dollar-driven shifts in capital flows.

Institutions like the Fed can control an overnight interest rate designed to set rates for other types of securities. But markets influenced by macroeconomic views, the outlook for inflation, and factors like political risks ultimately determine the borrowing costs footed by governments, companies and households.

It is those rates that can propel or depress an economy, and feed or stifle inflation. The issue before policymakers is whether the recent market moves have gone beyond what is needed to tame inflation and created unwanted risks to growth.

So far, the moves do not suggest a burgeoning crisis, economists at Capital Economics wrote last week, saying comparisons to last year's upheaval over U.K. government bond yields or the market illiquidity seen at the start of the pandemic are overblown.

But it's also the type of environment that could "morph into something more serious" if bond losses push a key institution towards insolvency, as happened at California-based Silicon Valley Bank in March, or erodes confidence to the point where holders of securities start selling at fire-sale prices, they wrote.

The fallout depends on "how much further, and how quickly, bond yields rise," they said. "The big risk stems from an unanticipated tightening of financial conditions" that would strain government, household and business budgets alike, translate into bank stress, and reverse economic growth.

(Reporting by Howard Schneider;Editing by Dan Burns and Paul Simao)