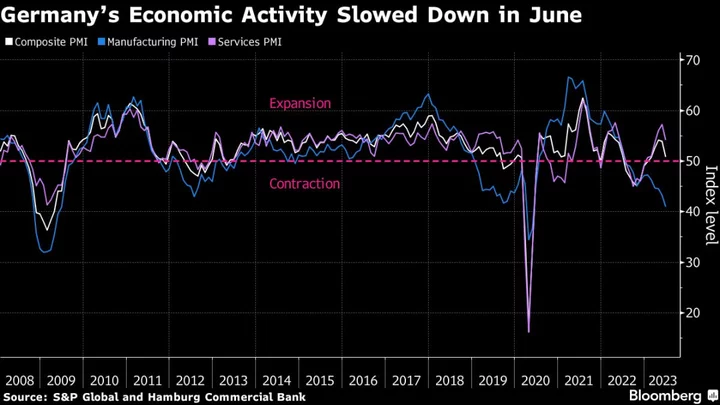

Germany’s economic activity lost much more momentum than anticipated in June, driven by a slowdown in services and sustained weakness at the country’s factories.

While the private-sector economy grew for a fifth straight month, the rate of expansion was the weakest since February, according to business surveys by S&P Global. At 50.8 — weaker than predicted by economists in a Bloomberg survey — it stayed above the 50 level that separates expansion and contraction. The manufacturing gauge has been below that line since July.

It was the services sector that saved the day as it “expanded quite strongly throughout the second quarter, although the pace of growth slowed somewhat in June,” said Cyrus de la Rubia, chief economist at Hamburg Commercial Bank. “In manufacturing, all signs point to a contraction.”

That sector saw order books fall at the sharpest pace for eight months amid reports of customer hesitancy and destocking, according to the survey.

Germany experienced a winter recession, though most economists see it rebounding and returning to growth in the current quarter. Still, overall output this year looks dire with the Bundesbank and the International monetary fund both forecasting an annual contraction, while the European Commission is still predicting growth.

PMI readings for the euro area, the UK and the US later on Friday are predicted to show a slowdown. Data earlier revealed similar trends in Japan and Australia, as well as a contraction in France.

--With assistance from Mark Evans and Joel Rinneby.