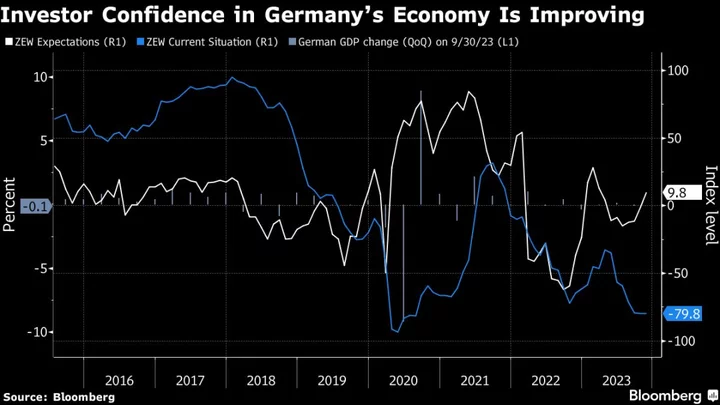

Germany’s investor outlook improved for a fourth month, signaling hope that Europe’s biggest economy may be stabilizing as inflation retreats.

An expectations index by the ZEW institute rose to 9.8 in November from -1.1 in October — better than economists had predicted in a Bloomberg survey. A measure of current conditions was little changed at -79.8.

The data “support the impression that the economic development in Germany has bottomed out,” ZEW President Achim Wambach said in a statement. “The heightened economic expectations are accompanied by significantly more optimistic outlooks for the German industrial sector and both domestic and foreign stock markets.”

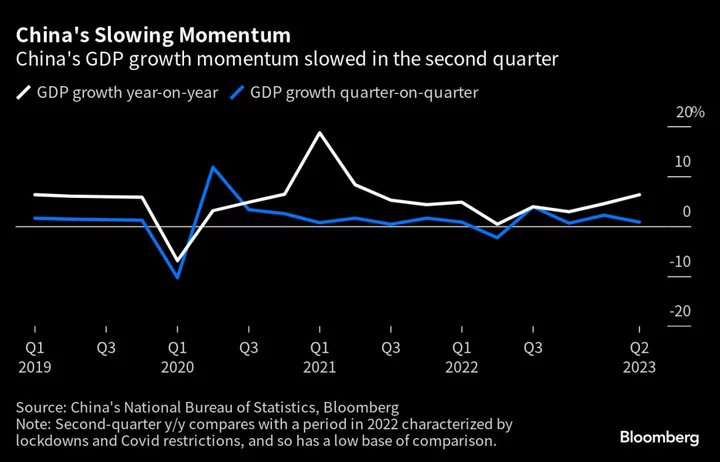

Germany is at risk of a shallow downturn after output shrank 0.1% in the three months through September, with a contraction of the same magnitude forecast by economists for the final quarter of the year. The country’s manufacturing sector has been weighed down particularly by global monetary tightening and a slowdown in China.

Retailers are also pessimistic about Christmas sales, citing geopolitical upheaval that’s weighing on consumer sentiment.

Data released on Tuesday by Eurostat in Luxembourg confirmed that the euro-zone economy shrank by 0.1% in the third quarter.

Former European Central Bank chief Mario Draghi reckons that the region is probably in a recession, while policymakers are less pessimistic, anticipating stagnation.

But with inflation on the back foot and wages on the rise, households’ purchasing power is set to improve and seen driving a modest rebound next year. Chancellor Olaf Scholz’s economic advisers last week predicted 0.7% growth in 2024.

The ECB is meanwhile likely to have finished its interest-rate-hiking spree that started in mid-2022, though President Christine Lagarde reiterated on Friday that borrowing costs will have to stay at the current level for a while to defeat inflation.

--With assistance from Joel Rinneby, Kristian Siedenburg and Sonja Wind.

(Updates with comment from ZEW’s Wambach in third paragraph.)