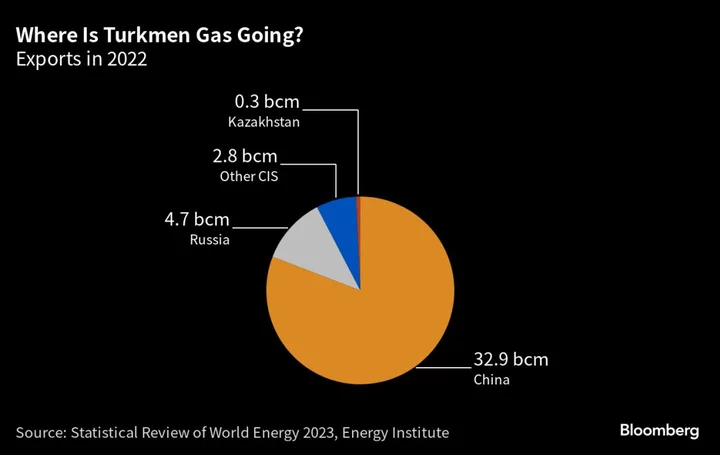

Turkmenistan, which sits atop the world’s fourth-largest natural gas reserves, is running out of time in its efforts to feed Europe’s hot market for the fuel.

The country is losing out to other nations as Europe seeks new supply lines following an historic energy crisis. Its proposal to build a multibillion-dollar gas pipeline across the Caspian Sea faces major financing challenges, and climate change is quickly diminishing the appeal of big fossil-fuel projects.

All of which means that if Turkmenistan wants to become a gas provider to the EU, it needs to act quickly.

The country is seeking to rally support for a Trans-Caspian pipeline — an idea that has been around since 2007 — even as less expensive and more immediate options remain available.

“Turkmenistan is convinced that there are no political, economic, financial factors hindering the construction of the gas pipeline,” the foreign ministry said in a rare public statement earlier this month.

Sitting at the crossroads of Asia, the country is potentially well-positioned to supply some of the world’s fastest-growing markets for gas. At the moment, there are few places where the need is greater than the European Union, which is taking unprecedented steps to replace Russian flows due to the Kremlin’s war in Ukraine.

However, Turkmenistan, a former Soviet republic that maintains close relations with Russia, has limited ties to the West. There are currently no contacts with Turkmenistan regarding future gas exports, an EU official said.

The pipeline would ship as much as 30 billion cubic meters of gas a year — equivalent to Italy’s demand for six months — across the Caspian seabed. Cost estimates for such a project vary widely, as much as $2 billion or more, and it could take years to build.

“The main question is who’s going to finance it,” Azerbaijan President Ilham Aliyev, said of the proposed pipeline recently, adding that European banks are reluctant to fund major fossil-fuel projects. “It is very problematic from a realistic point of view.”

For now, there’s only one major pipeline system from the fuel-rich Caspian region to the EU — the Southern Gas Corridor, which starts in Azerbaijan and runs across Turkey and Greece to Italy.

Azerbaijan has offered its infrastructure to help transit Turkmen gas, but it has said the decision to build the Trans-Caspian pipeline lies with Turkmenistan. Two fields in the Caspian are in proximity to the existing network, and their development wouldn’t require a connector pipeline across the sea, said Vitaliy Baylarbayov, deputy vice president of the State Oil Company of the Republic of Azerbaijan, known as Socar.

Officials from Turkmenistan’s energy ministry and state-owned Turkmengaz didn’t respond to a request for comment.

European Dialogue

The country’s dialogue with Europe has been slow-going compared to others. Hungarian Prime Minister Viktor Orban last month visited Ashgabat, the Turkmen capital, to spark a closer relationship on energy matters, but any actual supply deals remain elusive.

Meanwhile, European buyers have lined up with major exporters like the US and Qatar. Israel is also ramping up a gas project in the eastern Mediterranean, with the EU as a prospective customer.

“The problem is the lack of an open discussion between prospective customers and Turkmen authorities. Very occasionally, once in maybe 10 years you get a discussion like this with Turkmenistan,” said John Roberts, a UK-based energy security specialist with decades of experience studying Central Asia. “The single biggest thing they can do is look out and see they can find buyers in Europe and to do so, they need to open communications.”

While a massive pipeline faces financing hurdles, a smaller project might enable exports to begin within months, at a cost of $400 million-$600 million, said Roberts, who is also an adviser to Trans Caspian Resources Inc. The US company seeks to develop a 78-kilometer (48-mile) link between the Turkmen and Azerbaijani energy facilities in the Caspian Sea.

Russia Relations

In the background of any potential supplies to Europe is the bloc’s tense relationship with Russia, whose pipeline flows to the EU have slumped to a fraction of the levels before the war in Ukraine. Moscow might not look kindly on an ally capitalizing by filling the void.

Under a 2018 agreement, any transit pipeline across the Caspian Sea would require the approval of only Azerbaijan and Turkmenistan, removing concerns that Russia could block export plans in order to protect its own market share. Still, Turkmenistan may need to tread carefully in order not to spoil its relationship with Russia, said Ilham Shaban, an independent energy researcher in Baku.

Whatever option Turkmenistan pursues, time is running out to build a gas relationship with Europe, particularly as the region pivots toward renewables to meet its climate goals.

“Everything has its own lifetime,” said Socar’s Baylarbayov. “Appetite for gas is limited to the next 15-20 years.”

--With assistance from John Ainger.