Group of 20 finance ministers and central bank governors begin two days of meetings Monday, with participants set to discuss items including reform of multilateral development banks, debt relief for stressed developing nations and sustainable finance.

The gathering in Gandhinagar, capital of Indian Prime Minister Narendra Modi’s home state of Gujarat, is also serving as a setting for a raft of bilateral meetings. Treasury Secretary Janet Yellen on Monday engaged with her Indian counterpart, Nirmala Sitharaman — part of a broader push by the US to strengthen ties with the nation.

The meetings occur against a backdrop of tensions among G-20 members, capped off by US-China geostrategic rivalry and divisions over Russia’s invasion of Ukraine. The group’s finance chiefs haven’t agreed on a communique since February 2022, on the eve of the war.

“The G-20 has become a microcosm of global fractures,” said Philippe Dauba-Pantanacce, an economist and global geopolitical strategist at Standard Chartered Plc. While developed democracies have a “newfound sense of unity,” big emerging markets have “wide divergences in how/where each positions itself in this fragmenting world.”

Key Developments

- EU’s Gentiloni Says Too-Restrictive Fiscal Rules Unrealistic

- India, Indonesia Plan Local Currency Trade, Fast Payments Links

- Indonesia Upbeat on 5% Growth Despite Gloomy China Outlook

- Yellen Eyes China De-Escalation, But Lifting Tariffs ‘Premature’

- G-20 Host India Seeks Bilaterals for Consensus Language on War

(All times local)

Talks on Expanding Debt Relief Moving ‘Slowly,’ Gentiloni Says (11:30 a.m.)

European Economy Commissioner Paolo Gentiloni said that “it is much needed” to use the recent debt-relief agreement for Zambia as a template for others, but negotiations among G-20 members continue.

“It is moving very slowly,” Gentiloni told Bloomberg when asked about the talks. “Of course, part of the reason why we are meeting here in the G-20 is to resolve this issue. This is an open issue.”

Yellen is among a number of G-20 policymakers who are hoping the Zambia deal will serve as a template for similar agreements between creditors and other countries, including Ghana, Ethiopia and Sri Lanka.

China, the developing world’s biggest official creditor, has been reluctant to participate in multilateral agreements amid divided views over specific debt restructuring measures.

“We have seen a growing awareness of the debt problem, and the risk that it poses not only to the global economy and the financial system but particularly to dozens of countries that are maybe one step away from defaulting,” said United Nations Development Program Administrator Achim Steiner. But there’s a “very slow pace of actually addressing this problem,” he said.

Speaking on Bloomberg TV, Steiner also said “most of the world’s debt is held by private creditors. They are still reluctant to be part of a debt solution.” They need “stronger guarantees, more certainty” from official creditors, he said.

Yellen Meets India’s Sitharaman to Deepen Economic Partnership (9:40 a.m.)

US Treasury Secretary Janet Yellen used a meeting Monday with Indian Finance Minister Nirmala Sitharaman to declare their two countries were “among the closest partners in the world.”

The bilateral sit-down is the latest in a series of engagements between the two nations. Prime Minister Narendra Modi’s last month conducted a state visit to Washington, including his second address to the US Congress. Yellen also has singled out India in her “friend-shoring” push to revamp global supply chains in a way that reduces US dependence on China.

Yellen’s visit marks her third trip to India as Treasury secretary.

“Today’s discussions will highlight the commitment of India and the United States to activate and further the G-20 agenda, including addressing critical global issues such as strengthening the multilateral development banks and taking coordinated climate action,” Sitharaman said in remarks preceding the bilateral session.

India, Indonesia Plan Local Currency Trade, Fast Payments (8:40 a.m.)

Indonesia and India are planning to settle bilateral transactions in local currencies and link up their fast payments systems to spur cross-border fund transfers, according to a senior Indian government official.

India’s Sitharaman and her Indonesian counterpart Sri Mulyani Indrawati discussed the proposals ahead of meetings among the G-20 countries in India, said the official who asked not to be identified as the plans are not public.

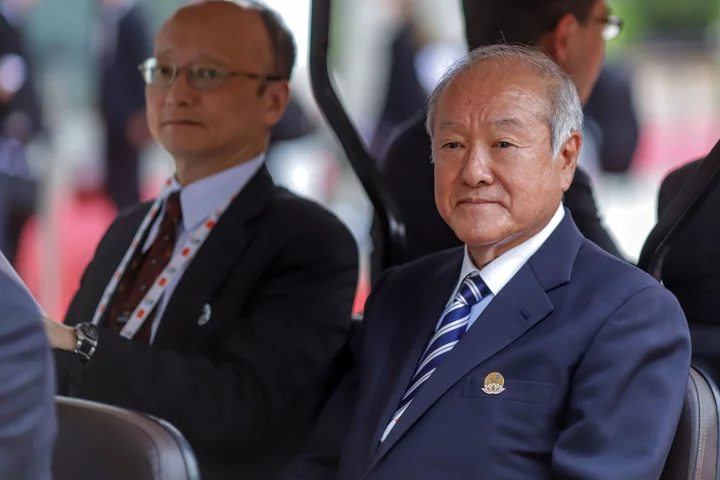

G-7 Continues Russian Asset Freeze, Japan Finance Minister Says (2:10 p.m. Sunday)

The Group of Seven nations have confirmed the continuation of a Russian asset freeze, Japan’s Finance Minister Shunichi Suzuki told reporters after a meeting in India Sunday. Japan earlier hosted the G-7 meeting in India, which Ukraine Finance Minister Sergii Marchenko also attended virtually.

On multilateral development bank reform, G-7 countries reiterated the importance of providing targeted support to leverage limited concessional financial resources and mobilizing private funds, Suzuki said. The group also welcomed an OECD international taxation package, part of a broader move to revamp global corporate levies.

War, Debt Distress, Inflation: G-20 Finance Chiefs Spar in India

There was no discussion of exchange rates at the meeting, Suzuki said.

Bank of Japan Governor Kazuo Ueda told reporters after the same meeting that the G-7 members shared that the global economy isn’t slowing as much as expected although uncertainty remains high going forward.