U.S. stock index futures fell on Tuesday as hawkish remarks from Federal Reserve officials last week kept investors jittery as they returned after a long weekend, while a smaller-than-expected rate cut in China further dented sentiment.

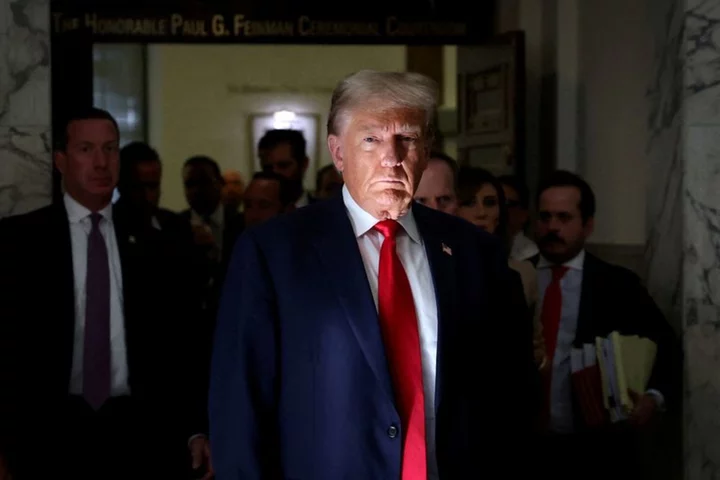

Fed Governor Christopher Waller warned on Friday "core inflation is not coming down like I thought it would." Richmond Fed President Thomas Barkin said he was "comfortable" with further rate increases given that inflation was still not on the path back to 2%.

Traders see a 74% chance of just one 25-basis-point rate hike this year, expected in July, even as the U.S. central bank has signaled that borrowing costs could rise as much as half a percentage point by year-end, according to CMEGroup's Fedwatch Tool.

The S&P 500 and Nasdaq ended lower on Friday, weighed down by Microsoft and other market heavyweights as comments from Waller and Barkin curtailed optimism that the central bank was nearing the end of its aggressive interest rate hikes.

Markets now await comments from more Fed officials including Fed Vice Chair Michael Barr later in the day, and Fed Chair Jerome Powell's semiannual monetary policy testimony to the U.S. House Financial Affairs Committee on Wednesday.

Adding to the dour mood, China cut its benchmark lending rates by a smaller-than-expected 10 basis points. This was the first cut in the country's loan prime rate in 10 months as it seeks to shore up its economic recovery.

U.S.-listed shares of Chinese companies including Alibaba Group, JD.com and PDD Holdings fell between 2% and 4% in premarket trading.

Alibaba Group also said Daniel Zhang would step down from his roles as CEO and chairman to focus on the company's cloud division.

At 5:19 a.m. ET, Dow e-minis were down 134 points, or 0.39%, S&P 500 e-minis were down 19 points, or 0.43%, and Nasdaq 100 e-minis were down 80 points, or 0.52%.

Adobe Inc lost 1.1% following a report that European antitrust regulators were preparing to launch a formal investigation into the Photoshop software maker's $20 billion buyout deal for cloud-based designer platform Figma later this year.

(Reporting by Shristi Achar A in Bengaluru; Editing by Vinay Dwivedi)