The dollar has defied predictions of a prolonged slump since at least the beginning of the year but top money managers say it’s now on borrowed time as US exceptionalism wanes.

The greenback is weakening as US interest rates near a peak and the Federal Reserve’s aggressive tightening begins to take a toll on the world’s largest economy, investors say. That will set the stage for the likes of the yen, kiwi and emerging-market currencies such as the Brazilian real and Colombian peso to strengthen, according to AllianceBernstein and UBS Asset Management.

The dollar’s resilience has confounded bears who had warned that the currency was headed for a multi-year decline following a surge in 2022. But there’s a growing conviction that they may finally be proven right as easing inflation backs the case for the US central bank to wrap up its rate-hike campaign in the coming months.

“Broadly we would probably assume that the US dollar has had its peak and there might be room for other currencies to perform better in the latter half of 2023-2024,” said Brad Gibson, co-head of Asia Pacific fixed income at AB. This is because the US economy will slow and the Fed is likely to start easing, he said.

The reaction to Wednesday’s cooling US inflation data appear to justify the tide of bearish calls against the greenback. The Bloomberg Dollar Spot Index slumped to a 15-month low, with the gauge now down over 11% from a September peak.

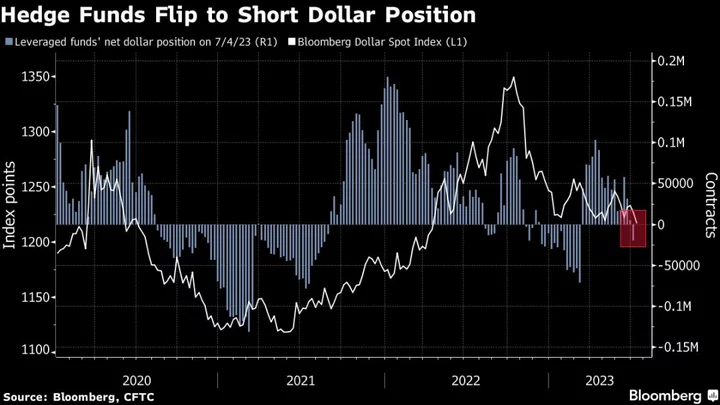

Hedge funds had been bracing for weakness, as they turned net sellers of the dollar for the first time since March, according to data from the Commodity Futures Trading Commission aggregated by Bloomberg.

Against this backdrop, investors are lining up their bets on which currencies will gain from the greenback’s decline. The yen is seen as a prime beneficiary with bulls seeing catalysts from fears of a US recession to narrowing yield differentials to speculation the Bank of Japan may tweak its ultra-loose policy in the coming months.

Jim Leaviss, chief investment officer of public fixed income at M&G Investments which oversees $366 billion, is shorting the dollar against the yen.

“There are lots of currency opportunities out there at the moment,” said Leaviss. “Quite a few of the emerging market currencies look cheap.”

Weaker Dollar

Every Group-of-10 currency has strengthened against the greenback over the past month. The yen rallied 4% in the past five sessions, the Swiss franc rose to the strongest since 2015, while the euro and pound reached their highest in more than a year.

Emerging currencies have also advanced, with a MSCI gauge of such assets up 2% this year after sliding 4% in 2022.

For UBS Asset’s Shamaila Khan, Latin American currencies including those of Brazil, Mexico, Chile and Colombia are likely to outperform. Every one of them has strengthened against the dollar this year, with the Colombian peso advancing 18% against the greenback.

“We like them due to the high yield, double digit carry they offer,” said New York-based Khan, head of fixed income for EM and Asia Pacific for the $1.1 trillion asset manager. “We expect a weaker dollar in the second half.”

Lombard Odier’s Christian Abuide also sees the real gaining, along with the Swiss franc, euro and yen.

“We favor the high carry yield offered by emerging markets such as the Brazilian real, which is benefiting from an environment of falling inflation and improving fiscal and external balances,” Abuide, head of asset allocation, wrote in a recent report.

What Bloomberg Strategists Say...

If you continue to believe, as we do, that the Fed rate will soon peak (though no 2023 cuts), in a softening (not hard landing) US growth story and in a continued risk-on market context, it makes sense to believe in a weaker dollar performance into 2H.

- Audrey Childe-Freeman, chief G-10 FX strategist. For the full note, click here

Haven Bids

Others are less certain the dollar will weaken further.

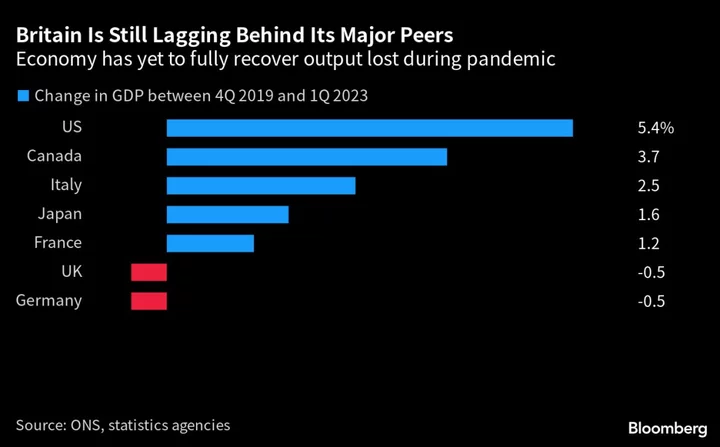

“We haven’t been taking much risk” in foreign exchange, said Brendan Murphy, a money manager at Insight Investment which oversees over $880 billion. “You still have these high and rising real rates, and you have growth concerns globally and the US — on a relative basis — is really doing better than say Europe or China.”

There are arguments in favor of a stronger dollar. The Fed may keep rates higher for longer if inflation doesn’t fall back within the central bank’s target. The world’s reserve currency also tends to strengthen amid risk aversion and worsening recession fears may spur renewed strength in the greenback.

But, overall there appears to be a growing consensus that the greenback’s best days are over for now.

Peaking US rates “takes away one of the supports for the dollar,” said Rajeev De Mello, a 36-year markets veteran and money manager at GAMA Asset Management, who is buying the Indian rupee and Mexican peso against the greenback. “That first phase of buying other currencies outside the dollar is already in motion.”

(Updates with BI strategist’s view in 16th paragraph)