First Quantum Minerals Ltd. has reduced operations at its flagship copper project in Panama, which is facing a groundswell of local opposition, after a blockade by small boats at its port affected delivery of key supplies.

The Canadian miner has found itself at the center of a political storm in the Central American country after thousands of protesters took to the street over an extension to its mining license. Under pressure from those demonstrators, President Laurentino Cortizo turned against the project at the end of last month, saying a referendum would be held on its future.

In the two weeks since, the referendum proposal and a push for congress to repeal the contract have both been shelved, as the government waits to see if the Supreme Court will kill the agreement instead. The dispute has called into question the very future of the mine that cost more than $10 billion to build.

An “illegal blockade” of small boats at Punta Rincon has hit the delivery of supplies to the mine, First Quantum said Monday. In response, the company was ramping down one ore-processing train, while two others remain operational. The loading of copper concentrate at the port was also being hindered, it said.

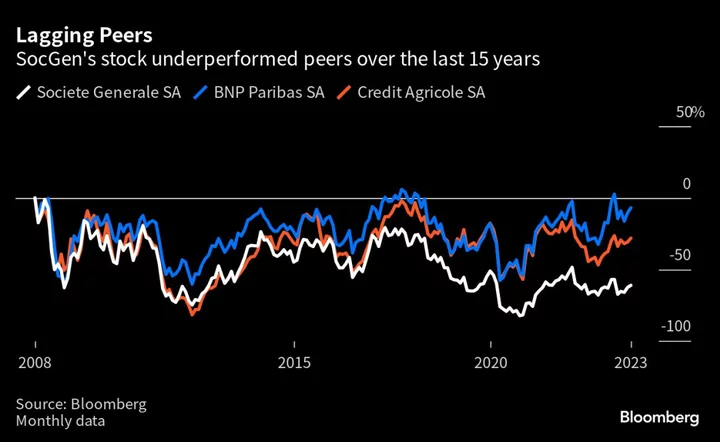

First Quantum has lost more than 40% of its value since Cortizo turned against the agreement in late October.

When First Quantum and the government reached a new arrangement for the mine in March, it seemed like a win-win. The company got a 20-year extension at its most lucrative asset, while the government received a bigger share of revenues, allowing it to boost pensions ahead of elections on May 5. Yet criticism of the deal simmered.

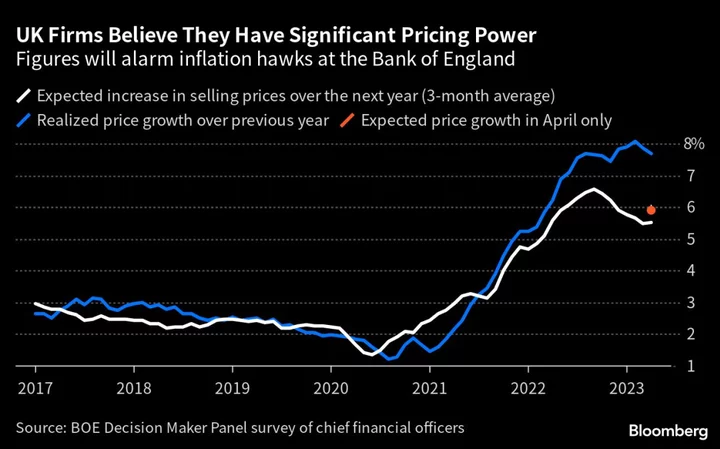

That exploded in October as environmentalists and student groups blocked highways and fought police, causing food prices in the capital to shoot up as farms were cut off. On Oct. 29, Cortizo tried to restore calm by calling for a referendum on the mine contract.

The Cobre Panama project is one of the world’s biggest and newest copper mines. The latest uncertainty over the mine comes as the future supply of copper has become a hot topic among global policymakers and business executives. While long-term supply of the metal is constrained, demand is forecast to surge as the global economy decarbonizes.

(Updates with details throughout)