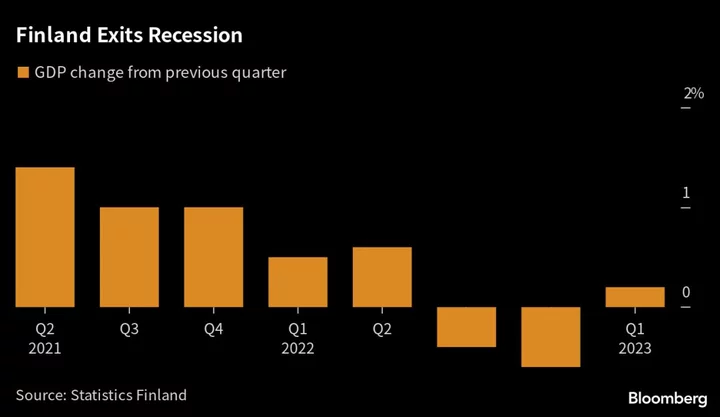

Finland’s economy grew clearly less in the first quarter than previously estimated, with consumers still helping the Nordic economy to exit a recession despite weak growth prospects for the rest of this year.

Gross domestic product grew 0.2% in the first quarter from the previous three-month period, when it contracted 0.6%, Statistics Finland said on Wednesday. A flash estimate had indicated a 1.1% growth in output. Contraction of investments dampened the growth of the economy while private consumption grew by 0.1%, it said.

Economic growth of the euro area’s northernmost member has been supported by lower energy prices and stable consumer spending, helping the Nordic nation to exit a two-quarter recession at the end of last year.

Still, it’s 2023 outlook remains weak and several economists have kept the forecast of a full-year recession, as the rise in interest rates, slowing consumer activity and the weakening flow of new orders weighs down the industry.

The revision “fits better with the prevailing interpretation of the state of the Finnish economy,” Jukka Appelqvist, chief economist with the Finnish Chamber of Commerce, said in an emailed comment. “The previously announced growth figures were suspiciously high. There is no upswing going on right now.”

Private investments shrank 2.6% on quarter and public investments dropped 5%, the data showed. Exports declined 0.1%. On an annual basis, the economy contracted 0.3%, adjusted for the number of working days.

Still, Nordea Bank Abp, the largest Nordic lender, sees Finland’s economic output remaining flat this year. The European Commission earlier this month forecast growth of 0.2% for the Finnish economy this year and 1.4% in 2024, helped by a boost from net exports and abating inflation.

Appelqvist of the Finnish Chamber of Commerce said the economic outlook is clouded by several factors, including a weakness of the euro area industry that hampers demand for Finnish exports. At the same time, consumers’ savings are starting to dwindle, weighing on private spending, while investments in construction are slowing rapidly, he said.

--With assistance from Joel Rinneby.