Slovakia needs to rein in public spending to keep its credibility on financial markets, according to the nation’s new prime minister.

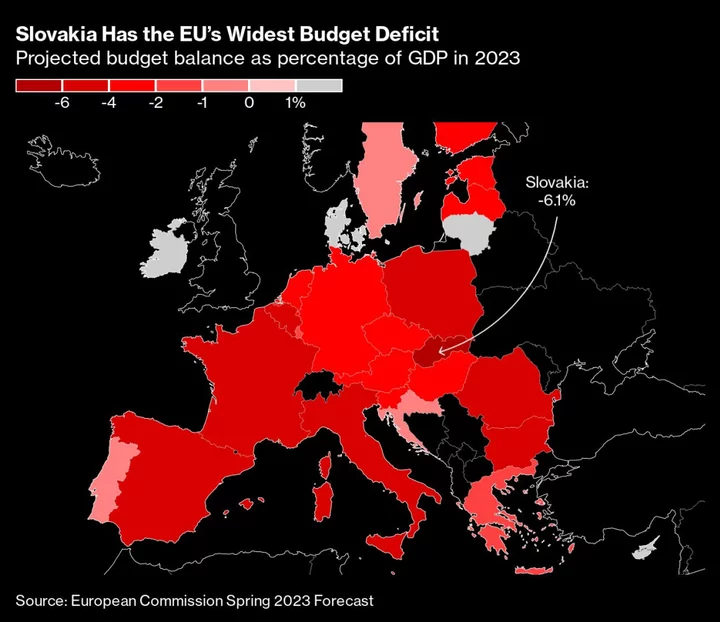

The euro member country needs to take immediate steps to lower the budget deficit that’s projected to top 6% of gross domestic product this year, the widest in the European Union and Slovakia’s biggest shortfall for over a decade, Prime Minister Ludovit Odor said in an interview.

Odor, who took power last month and will stay in office until a snap election on Sept. 30, said his administration will prepare a set of measures that will aim to get the country’s spending back on track, regardless of what ruling coalition emerges after elections. His administration faces the initial confidence vote as early as Wednesday.

“Nobody takes the approved budget seriously,” he said. “We need to communicate that the party is over.”

The nation’s public debt increased to 59% of GDP this year from 48% in 2019 on spending related to the pandemic, the war in neighboring Ukraine and efforts to ease the cost of living crisis as inflation surged to 12.8% last year.

“Slovakia has no choice but to consolidate,” the 46-year-old former central banker said on Tuesday. “Public finances are not in good shape.”

Changes being prepared include a shift to targeted state aid and social payments, he said. Other proposals include higher taxes on consumption and a removal of various tax exceptions, he added.

The Council for Budget Responsibility, a fiscal watchdog, said this month that Slovakia needs to improve the general government balance by 6% of GDP to secure long-term sustainability of public debt.

“If we continue like this, the financial markets could punish us in the future,” Odor said. “For now, they trust us because they believe that the recovery plan will come.”

Slovakia sold €2 billion ($2.2 billion) of 10-year bonds two weeks ago, with demand topping €7.7 billion. The yield on the notes traded around 3.8% on Wednesday, little changed in their first week of trading and putting Slovakia’s cost of borrowing on par with lower-rated Greece.

Slovakia is rated A2 by Moody’s Investors Service and A+ at S&P Global Ratings, which earlier this month changed the outlook on the nation’s debt to stable from negative.

Still, it’s to be seen what impact his plans will have on the nation’s public finances as the parties that now lead opinion polls have shown no desire to cut public spending.

Parties led by Robert Fico and Peter Pellegrini respectively, have pledged to increase state spending to protect Slovak businesses and households from the consequences of the war and shocks in the global economy.

--With assistance from Zoe Schneeweiss and Andras Gergely.

(Updates with bond issuance, confidence vote from third paragraph)