European stocks dropped, snapping their longest winning streak since January, as earnings season rolled on and investors looked ahead to the Federal Reserve’s interest rate decision later today.

The Stoxx 600 Index fell 0.5% by the close in London, with the consumer products and services sub-index finishing the day as the gauge’s worst performer, as Europe’s largest company LVMH slumped after results showed further evidence of a slowdown in spending by wealthy US consumers.

LVMH’s results flagged how the sluggish economy had deterred some US shoppers from buying the brand’s high-end clothes and handbags, thus offsetting a rebound in China. Peers Kering SA, Hermes International and Moncler SpA all traded lower. Eyewear maker EssilorLuxottica SA’s revenue in its key North America region also failed to meet consensus.

Read more: France’s CAC 40 Underperforms as LVMH Drags Luxury Stocks Lower

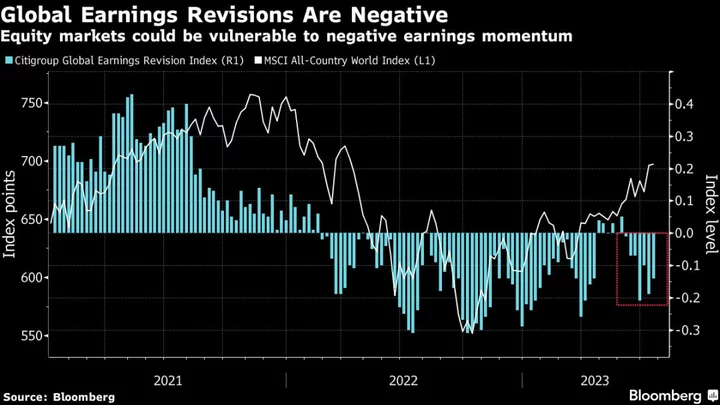

“We expect the earnings season to act as a drag on the market, with companies missing expectations/revising guidance,” said Susana Cruz, an equity research analyst at Liberum.

Meanwhile, Rolls-Royce Holdings Plc soared after the company said it will report earnings for the first half of 2023 that are “materially above consensus expectations” as surging demand for flying drives the need for jet engines to be serviced.

“As we get into the heart of the earnings season this week, investors are watching closely as to whether much of the enthusiasm that has driven the recent market rally is justified,” said Max Newman, equity specialist at Atomos.

“While concerns about an earnings recession amid disinflationary forces haven’t yet played out, I think the expansion in valuations into the run-up means that companies really need to convincingly beat expectations to grind higher,” he added. “Anything ‘in-line’ simply won’t be enough in many cases.”

Puma SE was one of the few bright spots on the consumer products and services sub-index, gaining after the sportswear brand’s second-quarter earnings topped analyst estimates as demand in China rebounded for sneakers and apparel.

For more on equity markets:

- Retailers Fly High on Inflation and Wage Tailwinds: Taking Stock

- M&A Watch Europe: Verbund, Deutsche Bank, Covestro, Entain

- Amsterdam Is in Its Longest IPO Lull in a Decade: ECM Watch

- US Stock Futures Little Changed; PacWest Gains

- Paragon Flags Disruption in Buy-to-Let Market: The London Rush

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.