Europe’s natural gas reserves are almost full, though that still may not be enough to see the region through winter.

The continent’s storage levels hit 90.1% capacity on Aug. 16, according to the latest data from the industry group Gas Infrastructure Europe. That’s the highest on record for the time of year, and well ahead of the European Union’s Nov. 1 goal of reaching that marker.

However, inventories weren’t meant to provide all of the region’s winter gas supplies, and a storm of risks is brewing. Potential worker strikes in Australia threaten to tighten the global market for liquefied natural gas. Europe is still coping with lower flows from Russia amid the war in Ukraine. And prolonged outages in Norway recently have led to price spikes, a reminder of the market’s fragility.

In other words, Europe’s energy crisis isn’t over yet. Benchmark Dutch futures rose as much as 4.3% to €38.41 a megawatt-hour on Friday — and headed for a third weekly gain — on continued supply concerns.

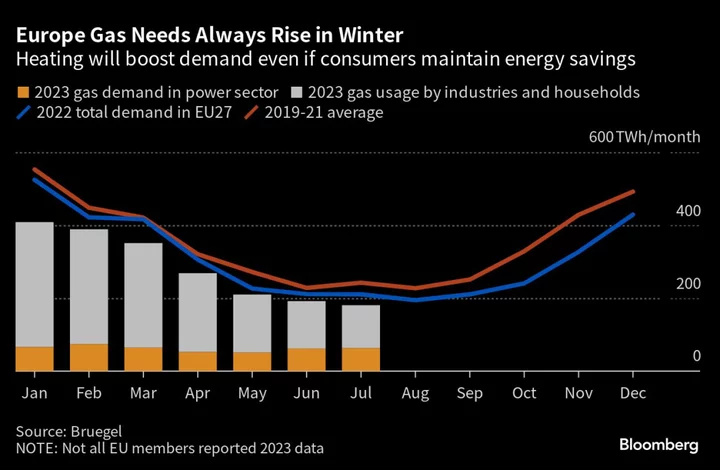

The region’s winter season for gas formally runs from October through March. When completely full, all of the EU’s underground gas inventories are sufficient to cover roughly 90 days of average winter demand, but much depends on weather conditions. Freezing temperatures could accelerate withdrawals from storage.

Read more: Why We Should Be Worried About Gas Prices Again

Gas inventories also vary by country. Nations including Germany, the Netherlands and Spain have already exceeded the EU’s target. France is among outsiders with storage levels at about 84%, after its energy supplies were disrupted earlier this year by nationwide strikes.

While European gas prices are about 90% lower than their crisis peaks last year, market nervousness and intense volatility are here to stay given that global supplies remain tight after Russia’s cuts.

Germany has already warned that shortage risks will remain until early 2027 unless it adds more gas infrastructure. Next year’s market balance will depend on how much fuel will be left in storage after this winter.

(Updates with prices in fourth paragraph.)