European natural gas futures fluctuated as forecasts for colder weather signaled a potential jump in heating demand.

Benchmark contracts traded between small gains and losses early Tuesday, after climbing 1.7% in the previous session. Large parts of the continent will see temperatures falling below seasonal norms this week and into early December, according to forecaster Maxar Technologies. At the same time, supplies in the region remain ample, with storage facilities 99% full.

Readings in Berlin are expected to be as cold as -2.5C on Wednesday, and as low as zero in London over the weekend.

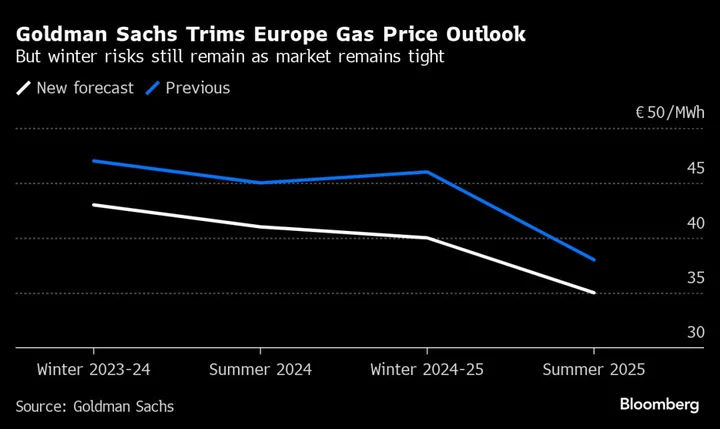

“Winter weather continues to pose significant risks,” Goldman Sachs Group Inc. analysts led by Samantha Dart said in a note. Still, the researchers trimmed their European gas-price forecasts due to better-than-expected supply and demand balances.

While gas prices have eased significantly from the record highs reached during last year’s crisis, traders have been on high alert for potential disruptions that could strain Europe’s energy supplies. Factors such as weather shocks or reduced gas-saving efforts from consumers could also still cause prices to as much as double if the market tightens, the Goldman analysts warned.

Renewed worries over the conflict in the Middle East escalating added to price pressures earlier this week after an Israeli-owned ship was seized in the Red Sea by Iran-backed rebels.

Dutch front-month gas, Europe’s benchmark, traded 0.8% lower at €45.45 a megawatt-hour by 9:36 a.m. in Amsterdam. The UK equivalent contract declined 0.7%.