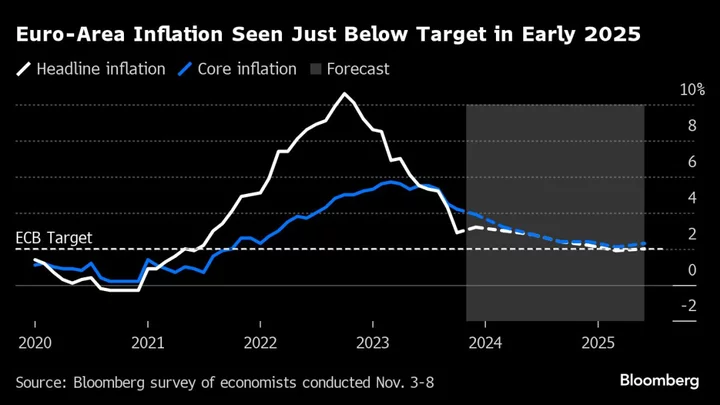

Euro-area inflation will sink below the 2% target in early 2025 — sooner than the European Central Bank predicts, according to economists.

Price gains will average 1.9% in the first quarter of that year, the latest Bloomberg survey showed — down from 2.2% previously. Projections from the ECB issued in September only foresaw a return to the goal in the second half of the year.

Economists predict the core rate will remain more elevated, however — at 2.1% and 2.3% in the first and second quarters of 2025.

The poll comes after inflation slowed to 2.9% last month — more than economists estimated. ECB officials have still warned of a difficult “last mile” back to price stability as government-aid measures to cope with the cost-of-living crisis are withdrawn and workers’ salaries rise.

The war between Israel and Hamas poses another important source of uncertainty for the economic outlook. But its impact on energy prices has so far remained contained, with crude prices falling in recent weeks.

The ECB last month held interest rates steady for the first time since it embarked on its tightening campaign in mid-2022. Economists now expect a first cut to come in June 2024, compared with September previously.

Greek central-bank governor Yannis Stournaras has said the ECB could consider lower borrowing costs from mid-next year. Others have dismissed any talk about such moves as premature.