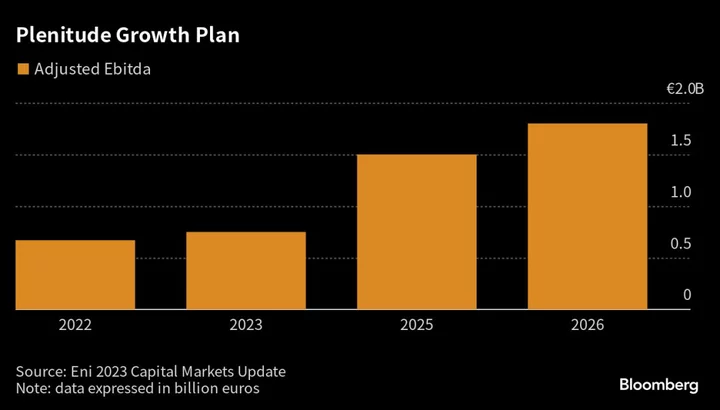

Eni SpA’s Plenitude renewables arm is on track to meet its profit target for 2023, as it prepares to list shares within the next two years and pushes to increase clean power generation, the unit’s chief executive officer said.

Plenitude is set to post adjusted earnings before interest, tax, depreciation and amortization of more than €700 million ($762 million) this year compared with €670 million in 2022, CEO Stefano Goberti said in an interview in Milan.

“In a challenging environment, Plenitude last year hit all its financial and operating targets in advance,” Goberti said. The performance underscores what he deems a “flexible” business model which “blends renewables-generated and commodity-linked energy.”

Milan-based Plenitude was set up to pool oil and gas major Eni’s energy retailing and renewables businesses. The unit employs about 2,500 people worldwide, with the bulk of activities concentrated in Europe, though it has growing exposure to the US and a minor presence in Kazakhstan.

It’s also nearly halfway to a target of 7 gigawatts of renewable installed capacity by 2026, as it expects to reach around 3 gigawatts by the end of this year, Goberti said.

Russia Effect

Plenitude’s original plans for a 2022 listing with a valuation of as much as €10 billion were put on hold following the Russian invasion of Ukraine and the concomitant hit to global energy markets.

While an IPO is still possible this year, it’s more likely to come in 2024, Eni CEO Claudio Descalzi said earlier this month.

In the meantime, Eni has been sounding out potential suitors on the sale of a minority stake, with Energy Infrastructure Partners AG among the interested parties, according to people familiar with the matter. Goberti declined to comment on the IPO or the potential stake sale.

“A sale would cause a delay in the IPO timeline, but it would provide investors with a valuation reference for a business model that currently does not have any fully comparable listed peers,” Jefferies wrote in a report on Tuesday confirming a valuation range of €8 billion to €12 billion.

The possible moves come at a time when Europe’s gas market is attracting a wider variety of participants after demand increased in the wake of the invasion. Liquefied natural gas has quickly replaced a part of the missing Russian pipeline supply and is seen as a vital fuel for years to come even as the region transitions to cleaner energy.

Plenitude’s business interests include selling energy to wind farms, solar panel activities and and a portfolio of electric-vehicle charging stations. It currently serves about 10 million retail clients — with a target of 11 million by 2025 — mainly in Italy, France, Greece, Portugal, Slovenia and Spain.

Read More: Eni in Talks With EIP to Sell Stake in Renewables Arm Plenitude

Retail accounts for about two-thirds of Plenitude’s profit, with the rest from renewables, Goberti said, noting that “the balance will change.”

That could come externally, though the company is “focused on organic growth, but we always look at opportunities,” Goberti, said.

As parent Eni progressively shifts toward gas with the recent acquisition of explorer Neptune Energy Group Ltd., Plenitude is reducing its emphasis and turning more toward renewables, especially in Italy, the CEO said.

“Currently our main market is Italy, where our retail customers are split at 60% gas/40% renewables,” he said. “We plan to make it 50/50 by 2025.”

The 2022 acquisition of BeCharge gives Plenitude 17,000 EV charging points, mainly in Italy. The company plans to expand that business throughout Europe, partly through Eni service stations, Goberti said.

The company’s fledgling US operations give it a chance to benefit from that country’s status as “fertile ground” for renewables investors, Goberti said, with opportunities driven by the Inflation Reduction Act.

“The US has taken the first steps” in renewables, the CEO said, but Europe is working to catch up, and Plenitude is positioned to benefit from stimulus measures on both sides of the Atlantic.

--With assistance from Anna Shiryaevskaya.

(Updates with analyst in ninth paragraph. A previous version was corrected to specify number of employees at unit.)