Emerging-market assets are heading for their best monthly gains of 2023 as traders reposition their portfolios on bets that the Federal Reserve will cut interest rates in the first half of next year.

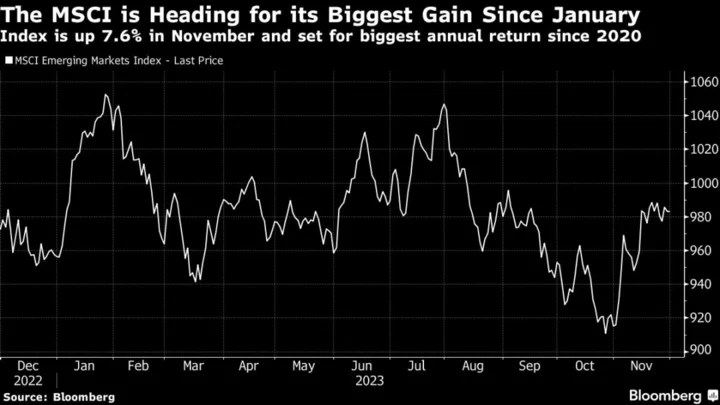

The MSCI Inc. emerging-market stocks index was set for a 7.6% increase in November, the largest monthly gain since January and putting it on track for its best year since 2020. A similar gauge of currencies is up 2.6% this month, the most in a year.

Traders also showed renewed interest in emerging-market bonds, helping to push down the extra yield investors demand to hold sovereign bond over US Treasuries by 24 basis points in November, the most since July, according to JPMorgan data.

Traders spent November bidding up emerging-markets stocks, bonds and currencies as expectations for a decline in US yields and a weaker dollar boosted the outlook for assets outside the US.

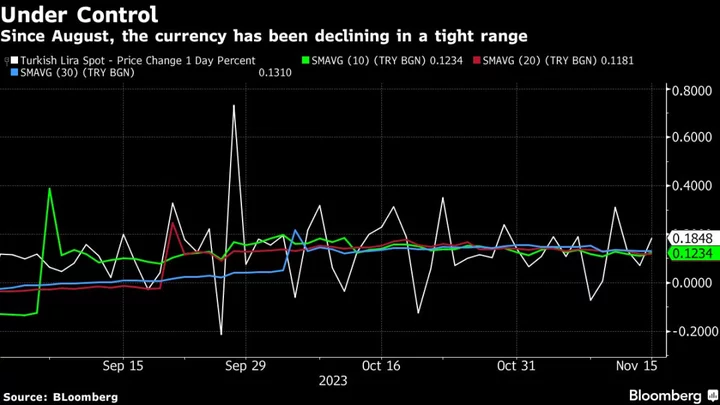

On Thursday, most emerging-market currencies took a breather from their November climb, with 21 of the most-traded currencies declining or holding steady against the dollar. The Turkish lira rose 0.3%.

Central European currencies followed the euro lower after euro-zone inflation cooled more than expected, spurring bets that the European Central Bank would cut interest rates sooner than officials suggest. Traders are now pricing in a quarter-point cut by April, compared with June just over a month ago.

For stocks, some valuation measures suggest the rally in emerging markets is set to continue.

By market capitalization as a percentage of gross domestic product, emerging markets are cheaper than developed ones and frontier markets are even cheaper, said Hasnain Malik of Tellimer Research, in a note earlier this week.

Author: Anthony Osae-Brown and Kevin Simauchi