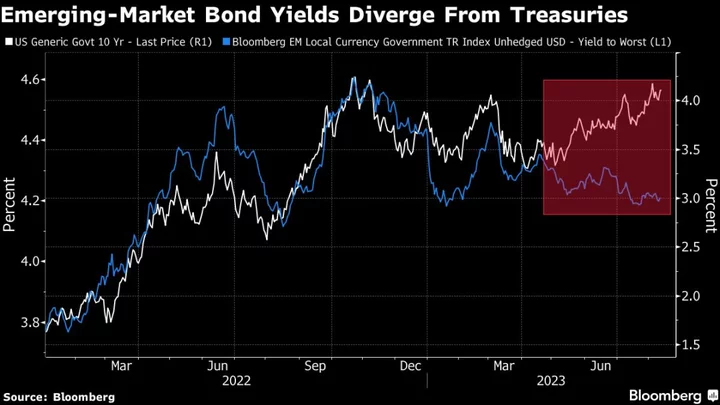

The old playbook of selling emerging-market bonds when Treasury yields spike is being upended by the positive dynamics favoring developing-nation debt.

Emerging bonds have extended this year’s rally — even as Treasuries slide — on growing expectations for interest-rate cuts and optimism over a global soft landing. The correlation between emerging and US yields has dropped to almost zero, a Bloomberg study shows.

“The disinflation process in emerging markets is proceeding faster than we had previously expected — this should allow EM central banks to cut rates sooner and faster than developed-market ones,” said Arun Sai, senior multi-asset strategist at Pictet Asset Management in London. “We remain overweight EM local-currency bonds.”

While the Federal Reserve and many of its developed-nation peers have left the door open for further rate hikes, some of their emerging-market counterparts have already started to cut borrowing costs.

Chile’s central bank lowered its key rate by a greater-than-expected 100 basis points last month, a decision that sent two-year bond yields plunging on the next trading day. Brazil’s policy makers trimmed their benchmark by a larger-than-forecast 50 basis points on Aug. 2.

The consensus for rate cuts in Latin America suggest markets are not yet pricing in the full extent of likely easing.

Elsewhere, Hungary’s central bank trimmed its key rate in a third-straight time last month, while policy easing is also being debated in Poland and the Czech Republic.

Soft Landing

Growing optimism the Fed will be able to counter inflation without bringing about a recession is also favoring emerging-market bonds more than their developed peers.

“Higher bond yields in developed markets signal a lower probability of a global recession,” said Rajeev De Mello, global macro portfolio manager at Gama Asset Management SA in Geneva. “I expect more resilient global growth to be the dominant force for emerging-market assets.”

The above factors help explain why the link between emerging-market bonds and Treasuries is breaking down. The 30-day correlation between US 10-year yields and a Bloomberg index of EM local-currency bonds has fallen to around 0.1, according to analysis by Bloomberg, where zero would indicate no correlation. When US yields surged in February, the correlation rose as high as 0.57, while in March to June 2022, it topped out at 0.61.

China Exports

The slowdown in China is also a positive for broader emerging-market bonds.

Recent data from the world’s second-largest economy has added to signs its recovery from the pandemic is faltering. Exports slid in July by the most in more than three years, while consumer and producer prices both dropped last month, the first time that’s happened since 2020.

The collapse in China’s export prices and the weak yuan mean the country is essentially “exporting disinflation” to its trading partners in Asia, especially in Southeast Asia, and that is “on the margin, a positive for both bonds and equities” in the region, Pictet’s Sai said.

Dollar Strength

Among the biggest negatives facing emerging-market bonds is a resurgent dollar, which will reduce returns from local-currency assets.

Dollar strength driven by the hawkish Fed has pushed down the MSCI emerging-market currency index by 1.5% in August, on track for the biggest monthly loss since February.

Still, “the dollar looks overvalued across a suite of valuation metrics, and is less of a headwind to EM local-currency bonds, making it likely that compelling carry can resume its role as key driver of returns,” Grant Webster, a fund manager at Ninety One UK Ltd. in London, wrote in a client note published Tuesday.

Dip Buyers

Even if emerging-market bonds do decline, any losses may be seen as a buying opportunity given the many positives.

A better time to be buying EM debt is during generalized selloffs due to risk aversion related to something else, such as in March with the US regional banks, Samy Muaddi, head of emerging markets fixed income at T. Rowe Price, said in an interview in Melbourne.

Correlation Between EM and US Bonds Has Fallen

What to Watch

- India, Poland and Argentina will release July inflation figures this week

- China will announce industrial production, retail sales and fixed asset investment numbers that may back the case for further stimulus

- Philippine policymakers will announce a rate decision Thursday

- GDP data is due from Malaysia, Taiwan, Colombia, Hungary, Poland and Chile

Author: Marcus Wong, Tassia Sipahutar and Matthew Burgess