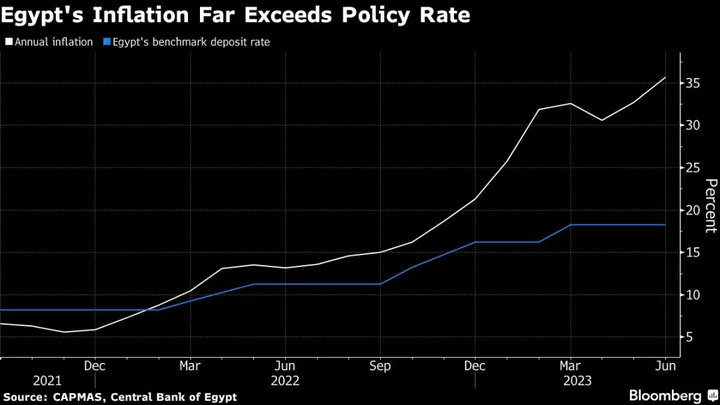

Not even record inflation looks likely to spur Egypt’s first interest-rate hike since March, with policymakers seen raiding other parts of their toolbox to tackle price pressures until a debilitating foreign-currency crunch is resolved.

Potential rate changes have been put on the backburner because the next raise is widely expected to come in tandem with another devaluation of Egypt’s beleaguered pound — and the North African nation’s authorities probably haven’t yet built up the dollar buffers from state-asset sales to enact the orderly currency transition they want.

All but one of 11 economists surveyed by Bloomberg predict the Monetary Policy Committee will leave its benchmark at 18.25% for a third straight meeting on Thursday.

“Although Egypt’s central bank is unlikely to raise the headline policy rates, we believe that it will consider raising the reserve requirement ratio,” said Gergely Urmossy, an emerging market strategist at Societe Generale in London. “But eventually an outright policy rate hike will be inevitable, in the same way that the pound’s devaluation is.”

The central bank has a choice of options since it seemingly “prefers to rather use other policy instruments than raise corridor rates to tame liquidity,” Cairo-based Naeem Brokerage said in a note this week. It cited the regulator’s absorption of 226 billion Egyptian pounds ($7.3 billion) of excess liquidity from banks in July via a range of tools.

The central bank said after June’s rate decision that it was open to using such steps to ensure “a tight monetary stance” and meet its inflation target of 5%-9% by the final quarter of 2024.

Read More: Egypt Races to End Pound Dilemma in Hunt for Gulf, IMF Cash

Inflation projections may also bear out a hold. Although consumer prices quickened sharply to an annual 35.7% in June, analysts at Cairo-based CI Capital wrote in a recent note that the 2023 peak may have passed, with “broad stability in the FX rate in the official and parallel markets over the past months.”

Not only that, central bank Governor Hassan Abdalla’s April comments that higher rates can do little to contain price growth make it less likely he’ll be in a hurry to add to the 10 percentage points of tightening the regulator has enacted since March 2022, when Egypt plunged into its economic crisis.

Read More: Egypt Can’t Stand More Price Hikes After Pound Float, Sisi Says

The pound has been allowed to lose half its value over that same period, helping the Middle East’s most populous country secure a $3 billion International Monetary Fund rescue package.

Now the question is when authorities take the next step in loosening control of the currency, which has been kept stable at 30.9 per dollar in banks for months and is trading around 38 on the local parallel market.

Read More: Egypt Currency Squeeze Sinks Bank Foreign Buffers to New Low

But the approach has come at a cost, draining the economy of foreign exchange. Net foreign liabilities of commercial banks hit an all-time high in June.

Securing hard currency is the government’s top priority. Last month, they agreed a sale of $1.9 billion in state assets to local firms and ADQ, an Abu Dhabi wealth fund — a significant step in a broad plan announced in February to turn around the economy.

Authorities target finalizing the deals this month and receiving the proceeds by September, CNN Arabic reported last week, citing an unidentified official.

“The government seems to have a preference for accumulating a bigger FX buffer before letting the pound float, to contain the potential impact on the cost of living and fiscal accounts,” Morgan Stanley economists including Alina Slyusarchuk said in a report.

“Our base case is for the IMF program to remain in place with first and second reviews likely to be completed between September and December, which we think will require further adjustments in FX and rates,” they said.

--With assistance from Harumi Ichikura.