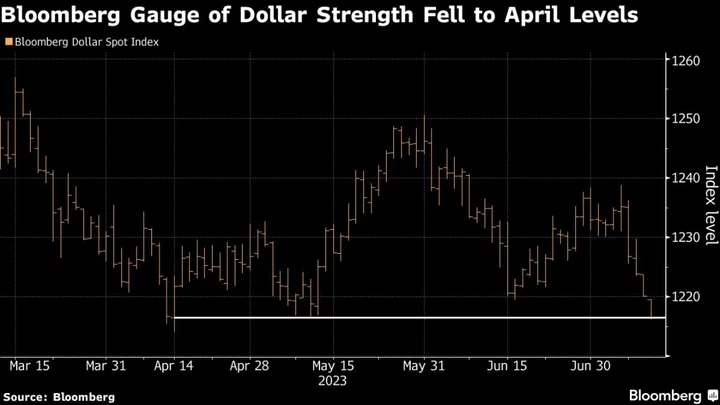

A gauge of the dollar’s strength fell to a three-month low before a US inflation report that may reinforce bets the Federal Reserve is nearing the end of its tightening campaign.

The Bloomberg Dollar Spot Index fell as much as 0.3% to the weakest since April 14 on Wednesday, pressured as the US currency broke below a key 140 level versus the yen. The greenback is approaching its weakest against the Swiss franc since 2015, while the pound is on the cusp of hitting $1.30 for the first time in over a year.

The moves have picked up this week as economists expect June figures to show US consumer-price growth decelerated on an annual basis, with the headline print likely to have fallen to the lowest since March 2021.

“Expectations of the Fed reaching the end of its rate-hiking cycle and further cooling of US CPI will likely reinforce bearish dollar bets,” said Ken Cheung, strategist at Mizuho Bank Ltd. in Hong Kong. “Traders may also be trimming their long dollar positions in carry trades.”

Bullish dollar bets are losing appeal among traders as signs mount that US interest rates may be approaching a peak. The Bloomberg Dollar Spot Index has tumbled more than 10% from its September peak and hedge funds turned negative on the currency for the first time since March.

The greenback’s losses this week coincided with a resurgence in other Group-of-10 currencies. The yen, which has the second-largest weighting in the Bloomberg gauge after the euro, was the day’s biggest outperformer Wednesday as traders positioned for the possibility that the Bank of Japan may modify its yield curve control policy later this month.

Expectations of more rate hikes by the Bank of England and also the Swiss National Bank were supporting the pound and the franc.

“The dollar is firmly on the backfoot,” said Khoon Goh, head of Asia research at Australia & New Zealand Banking Group Ltd. in Singapore. The Dollar Index is likely to lurch lower, and “a weaker-than-expected US CPI tonight could certainly deliver the catalyst for this move.”

Wednesday’s inflation print could add to the view that the US economy is heading for a soft landing, which would eventually stoke demand for riskier assets and weigh on the dollar. But it may be too early for the tide to turn on the dollar on the CPI reading alone, some analysts say.

“There likely needs to be more of a slowdown in US growth/activity data before the turn to a more sustained trend lower in US yields and USD,” said Erik Nelson, a currency strategist at Wells Fargo in London.

“We could get some tactical USD selling after the CPI, but I don’t think we’re yet at a point where USD is on a sustained path lower. The relative growth dynamics need to change — we especially need to see some improvement in European and Chinese growth prospects for a weaker USD,” he added.

--With assistance from Ruth Carson and Naomi Tajitsu.

(Updates throughout, adds comment.)