Chinese developer Country Garden Holding Co.’s stock and bonds plunged as noteholders said they haven’t received coupon payments effectively due Monday, further darkening sentiment in the crisis-stricken property sector.

Some holders of two different notes said they didn’t receive coupon payments as of Tuesday afternoon. The investors asked not to be named as they’re not authorized to speak publicly. The company owed $10.5 million of interest on a dollar bond that matures in 2026 and $12 million on a note due 2030, according to data compiled by Bloomberg.

Both bonds have a 30-grace period before a missed coupon payment can constitute a default, according to the notes’ prospectuses.

China’s sixth-largest builder by contracted sales, Country Garden is one of the few major developers there yet to default. A failure to pay its debts would pummel fragile market confidence, just as Beijing seeks to revive a property market mired in a years-long crisis. While the central bank pledged more support last week, investors remain uncertain over the pace and extent of policy action and have been reluctant to back fund-raising attempts.

“It seems like more investors are betting on Country Garden’s liquidity concerns leading to its failure,” said Patrick Wong, a Bloomberg Intelligence analyst. The firm “has a sizable amount of projects, so any default will significantly affect the overall property market sentiment and hit other developers.”

Reuters earlier reported that Country Garden said it missed the coupon payments, without stating how the company communicated the information.

Country Garden’s equity and dollar notes fell to their lowest levels since November on Tuesday, with shares dropping 14% in Hong Kong. The developer’s next dollar bond to mature, due Jan. 27, slumped 12 cents to 11 cents, according to prices compiled by Bloomberg. A BI stock gauge of the sector declined nearly 4%, one of the largest drops this year.

The builder faces more than $2 billion of bond payments across all currencies the rest of this year, Bloomberg-compiled data show. One of Country Garden’s units recently wired cash to cover early repayment of a yuan bond, people familiar with the matter told Bloomberg News. All of that note’s holders chose to exercise a put option.

China’s real estate industry, a key driver for the economy, is caught in a vicious cycle where failing developers put homebuyers off purchases, which then crimped the cash flow of companies. Unprecedented protests broke out across cities last year as builders ran out of cash to complete and deliver apartments to buyers, spurring policymakers to intervene.

Home sales in the nation tumbled the most in a year last month, as confidence crumbled after an initial uplift earlier.

In a statement Tuesday, Foshan-based Country Garden underscored the challenges by saying a deterioration in sales and the refinancing environment has crimped its cash flow, which has continuously decreased.

The firm didn’t respond to questions about whether it had made coupon payments. The two that bondholders say they haven’t received were effectively due Monday as the original date fell on a Sunday.

Concerns about the developer’s liquidity increased after it scrapped a share-sale plan last week, while firms from Moody’s Corp. to JPMorgan Chase & Co. have downgraded its bonds and stocks. Contracted sales plunged 60% from a year earlier in July, and analysts say Country Garden’s relatively high exposure to lower-tier Chinese cities leaves it vulnerable to weaker home sales.

Shares have slumped 58% this year as investors become increasingly doubtful whether it can hold out as a rare survivor of the wave of defaults that has engulfed the sector since early 2021. Country Garden said last week it expects to swing to a net loss for the first half of 2023.

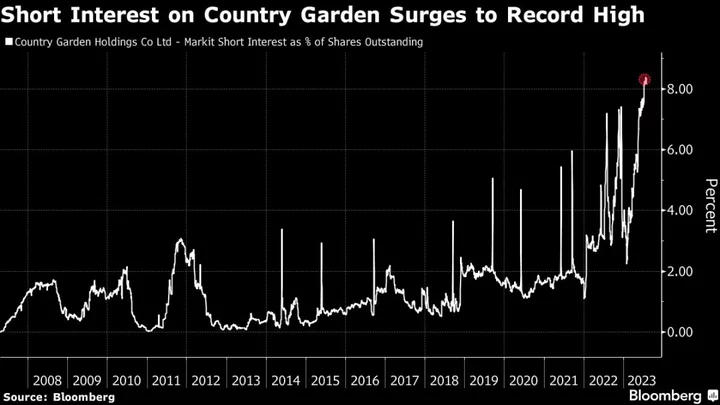

Short interest as a percentage of outstanding stock jumped above 8% to a record, making Country Garden and its property-management arm the most-shorted members of the Hang Seng Index.

No Aid

And while there are signs policymakers intend to move quicker to help developers, it’s not clear Country Garden is among the intended beneficiaries. Its executives were missing from a list of representatives that People’s Bank of China Governor Pan Gongsheng met with recently, when the central bank had said it wanted to hear about their difficulties.

“Any liquidity issues at Country Garden could impact delivery of up to 651,000 presold homes in China, but that doesn’t necessarily mean authorities would intervene to help it if needed,” said Kristy Hung, an analyst at Bloomberg Intelligence. “Policy aid to the sector so far has stopped short of bailing out individual firms, and Country Garden’s business strategy means it could face long-term pressures.”

--With assistance from Alice Huang, Jackie Cai, Emma Dong, Dorothy Ma and Pearl Liu.