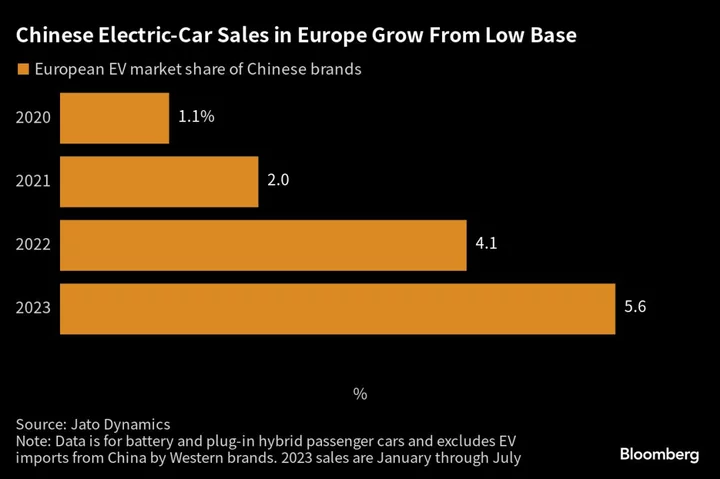

Electric-car maker Zeekr is banking on extra momentum from sister brands like Volvo Car AB to push into Europe, just as Chinese carmakers’ ambitions in the region move into the crosshairs of global trade tensions.

The brand, part of billionaire Li Shufu’s sprawling auto empire that includes stakes in Mercedes-Benz Group AG, started European sales of two models just weeks ago and plans to add another seven by 2025. The aspirations could hit a roadblock should the European Union impose extra import tariffs on Chinese EVs, after opening a probe into state aid last week.

Read more: Europe’s China Probe Exposes ‘Massive’ Competitiveness Problem

Being part of Li’s Zhejiang Geely Holding Group Co Ltd. “is giving us an important headstart,” Europe head Spiros Fotinos said in an interview, declining to comment on the EU’s investigation. “Geely has established itself through Volvo, Polestar and Lynk & Co. — that adds a trust mark.”

Founded as a standalone brand in 2021, Zeekr in late June started sales of the €59,490 001 sedan and €44,990 X compact SUV models, which compete with Volkswagen AG’s ID.7 and BMW AG’s iX1. To warm European customers to an unknown Chinese automaker, a team of more than 500 helps design its models in Gothenburg. The efforts could help set Zeekr apart as BYD, Nio and Great Wall lead a range of Chinese companies taking aim at Europe.

Zeekr’s ambitions may stall on souring trade relations. Last week, European Commission President Ursula von der Leyen kicked off a probe into potentially unfair state support of China’s EV makers, a move the country branded as “naked protectionism.” The investigation could hit almost $7 billion of electric car and van imports with tariffs possible by June, according to Bloomberg Intelligence. The EU’s top trade negotiator Valdis Dombrovskis, who is on a four-day trip to China, said the bloc is seeking a new strategy toward the country, calling the current relationship “very imbalanced.”

Read more: EU Negotiator Says Trade Relations with China ‘Very Imbalanced’

For parent company Geely, pulling off Zeekr’s arrival in Europe would help shape a hodgepodge of auto holdings and reap economies of scale. The Hangzhou-based company has been building European roots since taking over Volvo Cars from Ford Motor Co. in 2010, with its network spanning stakes in truckmaker Volvo AB to control of sports-car maker Lotus. It’s also finalizing a deal with Renault SA to pool combustion-engine assets.

Zeekr’s 001 and X are made on the same underpinnings that also produce Volvo’s EX30 compact SUV and Mercedes’ Smart city car. This year, Zeekr is targeting sales of 140,000 cars, even as EV maker in China battle a cut-throat price war. This is set to jump to 650,000 by 2025. In Europe, the first deliveries to Sweden and Netherlands are scheduled for November. Sales also started in Germany this month.

By adding more models to the portfolio, Zeekr will be able to “fuel growth in the Chinese market, but also “unlock the potential in Europe and other regions,” said Fotinos, a former Toyota Motor Corp. executive.

By 2025 the company expects to offer cars in much of Western Europe.

“North America’s a different discussion. It’s a different market,” Fotinos said. “It’s a market that we’re looking at and taking very seriously.”

(Adds detail on EU trade negotiator Dombrovski’s China visit in fifth paragraph)