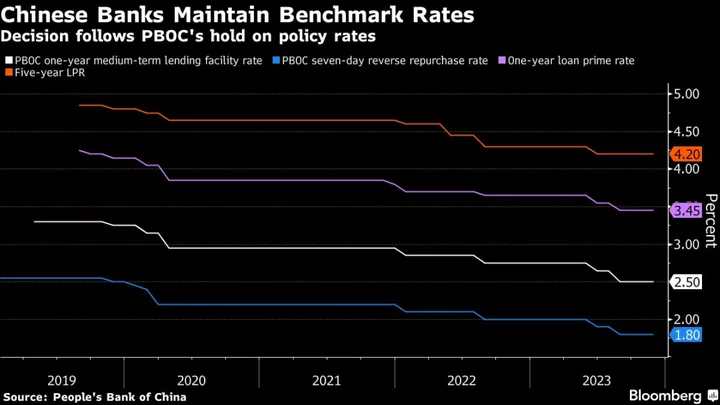

China’s commercial lenders held their benchmark lending rates steady on Monday, in line with the central bank’s decision earlier this month to maintain policy rates in favor of other means to support stimulus spending.

The one-year loan prime rate was held at 3.45%, in line with the forecasts from almost every economist surveyed by Bloomberg. The five-year rate, a reference for mortgages, was kept at 4.2%, according to the People’s Bank of China. That also broadly matched expectations.

The offshore yuan mildly extended its morning gains to 0.2% after the announcement, hitting a three-month high at about 7.2 against a soft US dollar. Ten-year government bond yields were little changed at 2.66%.

The loan rates are based on the interest rates that 18 banks offer their best customers, and are published by the PBOC monthly. They are quoted as a spread over the central bank’s one-year policy rate, or the medium-term lending facility rate.

The central bank kept that rate unchanged last week following cuts in June and August. Instead, policymakers chose to pump the most cash into the financial system since late 2016 through its one-year loans. That was intended to help meet liquidity needs spurred by Beijing’s move to support the economy via an unusual sale of sovereign bonds.

“Quantitative measures – liquidity injections – are still preferred over outright interest rate cuts to stimulate economic activities,” said Frances Cheung, a rates strategist at Oversea-Chinese Banking Corp. “With the earlier outsized MLF operations, the authorities may adopt a wait-and-see approach for now regarding further liquidity releases but an RRR cut is still possible.”

The PBOC faces constraints on its ability to cut policy rates further due to pressures on the yuan and capital outflows. Profit margins of banks have also been narrowing, posing another limit. Deposit rates have declined at a slower pace than lending rates in recent years, and a rise in time deposits also pushed up lenders’ costs.

What Bloomberg Economics Says ...

“The decision by China’s commercial lenders to keep their prime rates steady on Monday was almost a foregone conclusion after the People’s Bank of China held rates last week. The question is, what’s next? We expect additional easing, but with measures focused more on stimulating credit growth rather than lowering borrowing costs.”

— Eric Zhu, economist

Read the full report here.

The outsized cash injection sparked discussion over whether the central bank will still cut the reserve requirement ratio for banks — which determines the amount of cash lenders need to keep in reserve — before the end of the year. Citigroup Inc. economists have said last week’s move may mean the RRR cut is delayed into 2024.

Banks are also shouldering the responsibility of helping stabilize the property sector and credit growth. The central bank and other financial regulators told the country’s biggest lenders and asset managers to meet all “reasonable” funding needs from property firms in a meeting on Friday. China will stabilize credit growth from November through early next year to boost economic growth, they said.

--With assistance from Qizi Sun and Wenjin Lv.

(Updates with additional details throughout.)