China’s top leaders will fail to deliver big-bang stimulus for the weakening economy this week, economists say, disappointing financial markets seeking strong action to counter the downturn.

The July meeting of the Communist Party’s Politburo, the top decision-making body led by President Xi Jinping, usually covers economic policy. Senior officials typically don’t announce specific measures at these meetings, but the policy tone and language of the statement will provide important clues on how Beijing will respond in coming months.

Economists say the meeting will likely provide more pro-growth signals, which may lead to greater fiscal spending, moderate interest rate cuts and additional property easing. Support for the private sector could be top of the agenda after Beijing’s recent pledges, they say.

The meeting will likely “refrain from giving ‘strong medicine’ to the economy,” said Bruce Pang, chief economist and head of research for Greater China at Jones Lang LaSalle Inc. “There won’t be much aggressive stimulus policies that markets were expecting.”

Investors are already tempering expectations and bracing for prolonged gloom in the stock market. The benchmark index notched its worst week in four last week despite several pledges recently by Beijing to boost consumption and support businesses.

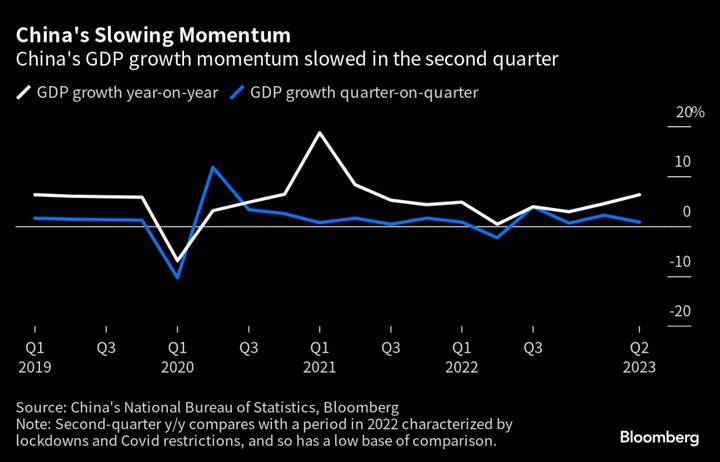

Authorities are resisting the kind of stimulus they’ve unleashed in past downturns to avoid over-stimulating the property market and driving up debt for already highly-leveraged local governments. Beijing is focused on improving the quality of growth, rather than the pace, and set a relatively conservative target of around 5% for this year — which it’s still largely on track to achieve.

Here’s a look at what economists expect from the Politburo meeting:

Fiscal Policy

More fiscal policy support is widely seen as necessary to boost weak domestic demand. But the chance of Beijing turning to unconventional tools, such as special sovereign bonds, as it’s done before, is slim. Wu Ge, chief economist at Changjiang Securities who has previously consulted with senior leaders, said at a recent conference this type of instrument would only be used under extreme conditions or national emergencies.

Instead of expanding the fiscal deficit target of 3% of gross domestic product, top leaders are likely to call for faster issuance of local government special bonds, which are mostly used to finance infrastructure projects, according to JLL’s Pang. They could also announce quasi-fiscal tools such as policy bank financing for infrastructure projects, he said. Resolving risks related to local government debt is likely another key focus, according to Ming Ming, chief economist at Citic Securities.

Monetary Policy

Central bank officials recently said they’re ready to ease monetary policy further to help the economy and hinted at steps including a cut to the amount of cash banks must keep in reserve. The Politburo meeting will likely foreshadow more modest easing steps from the People’s Bank of China, according to economists.

UBS Group AG expects a 10 basis-point reduction of policy interest rates and a 25 basis-point cut to the reserve requirement ratio in the second half of the year. Wu of Changjiang Securities sees a rate cut as a possibility in the third quarter. State media on Monday also highlighted the room for RRR and interest-rate cuts, as well as the need for more measures to expand domestic demand in the second half of this year.

Property Policy

Top leaders are likely to repeat Xi’s pledge that housing is not for speculation, but may hint at additional easing of property controls. The real estate market is in decline again after a short-lived rebound, suggesting more help is needed.

Policymakers are considering easing some of the home buying restrictions in the nation’s biggest cities, Bloomberg News has reported. UBS says aggressive easing may not be likely in tier-one cities, but officials could relax some purchase restrictions in smaller cities, lower the down payment ratios for buyers who already have a mortgage, and increase financing for stalled housing projects and property developers.

Consumption Boost

A comprehensive strategy is needed to boost the momentum of consumer spending, according to Citic’s Ming, who says policies around this will be a key focus at the Politburo meeting.

Retail sales slowed more than expected in June, threatening the sustainability of the economic recovery. The government has so far announced only incremental measures and made a number of pledges to boost the consumption of home appliances, furniture and cars, but investors are keen for more substantial policies.

Private Businesses

Beijing has wrapped its almost two-year regulatory crackdown on the tech industry and made a high-profile pledge last week to improve conditions for private firms. But “stronger signals are needed for reviving confidence,” said Larry Hu, head of China economics at Macquarie Group Ltd.

Private businesses are still reeling from years of stringent Covid controls and regulatory crackdowns. Wu of Changjiang Securities said it’s now necessary to clarify the role of private firms and private property in the Communist Party’s policies. A clear legal and institutional framework that stipulates areas private business can’t operate is needed so they can expand without fear, he said.

Authorities will have greater urgency to step up stimulus in the third quarter, since economic growth — measured in both year-on-year and quarter-on-quarter terms — may slow and the jobless rate rise, Wu said. He expects policies on various fronts, including monetary, fiscal, property and industrial policies, to be stepped up then.

“The top leaders are aware of the real economic situation,” said Wu. “They won’t rely on one single policy, because we need to achieve 5% growth this year after all.”

--With assistance from Fran Wang.