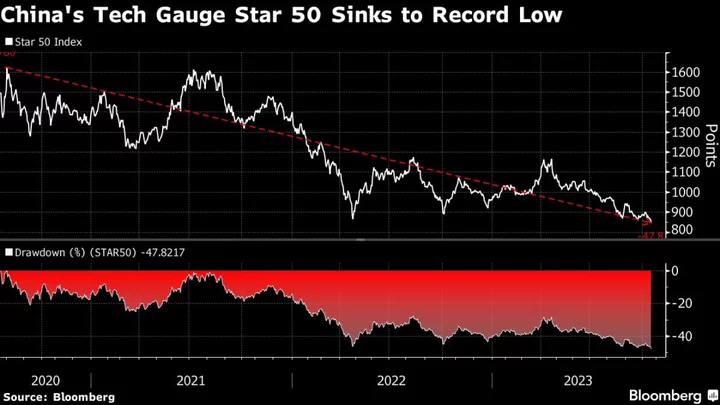

China’s gauge of tech equities fell to the lowest since its inception more than three years ago, worn down by concerns over higher US rates’ impact on global liquidity and a weak export outlook.

The Star 50 Index is down as much 1.9% Monday, set for a sixth month of decline. Cambricon Technologies Corp. plunged as much as 17%, leading the decliners on the gauge. Chipmakers ASR Microelectronics Co. and Loongson Technology Corp. each dropped at least 5%.

Chinese markets are seeing waves of selling as the country struggles with economic growth, and exports falter with high global interest rates affecting demand. The Hang Seng Tech Index, which also tracks listed Chinese companies, has dropped 11.3% this year.

“The biggest factor that is dragging on tech is liquidity conditions,” said Li Xuetong, a fund manager at Shenzhen Enjoy Equity Investment Fund Management Co. “And amid the Fed’s reluctance to lower, the electric vehicle and pharma stocks have a hard time funding and keeping current valuations.”

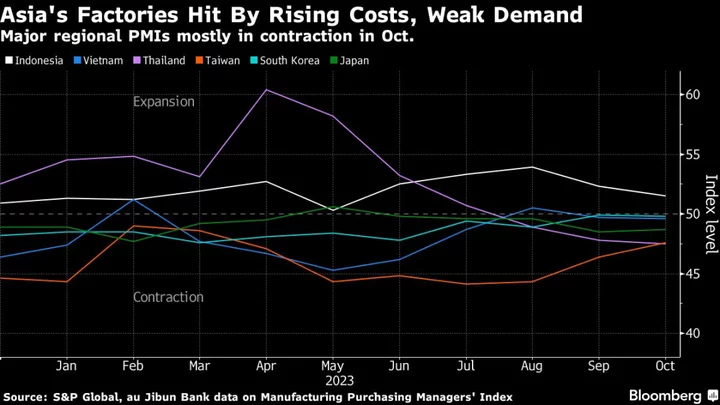

Meanwhile, the outlook for renewables exports — which impacts companies on Star 50 such as Trina Solar Co., Jinko Solar Co., and GoodWe Technologies Co. — has become less rosy. The European Union’s recent investigation into Chinese subsidies for electric vehicles “could hit almost $7 billion” in car and van shipments, Clelia Imperiali, an ESG trade analyst at Bloomberg Intelligence, said.

Huawei Technologies Co.’s recent releases of its M7 electric vehicles and the Mate 60 Pro smartphone have lifted traders’ demand for stocks related to the Chinese tech giant. But the Huawei boost has done little to move the index higher.

The Shanghai Composite Index dropping below the key level of 3,000 also set in motion forced-selling and client redemption that may be intensifying, Li noted.

The Star Board’s launch in Shanghai was a high-profile project announced in person by President Xi Jinping five years ago during the US-China trade war. It was intended to foster companies with core homegrown technology to counter US export restrictions.

The board was touted in its earlier phase as an experimental project to provide funding to early-stage firms. It was also a trial ground for a relaxed initial public offering process, known as the registration-based reform, that has now been expanded to the entire onshore market.

The index comprises of the 50 largest and most liquid firms on the Star board, led by Semiconductor Manufacturing International Corp., Beijing Kingsoft Office Software Inc. and Advanced Micro-Fabrication Equipment Inc.