For two hours on an early February morning, Sunac China Holdings Ltd. Chief Financial Officer Gao Xi delivered a tirade against bondholders — hitting the table as he told them the distressed developer had already made its best offer.

The negotiations were fraught enough that some creditors considered walking away during lunch. But Gao returned that afternoon with an apology, paving the way for a restructuring deal that took effect last week and marked the first of its kind by a major Chinese builder since Beijing’s deleveraging push three years ago set off a historic industry crisis.

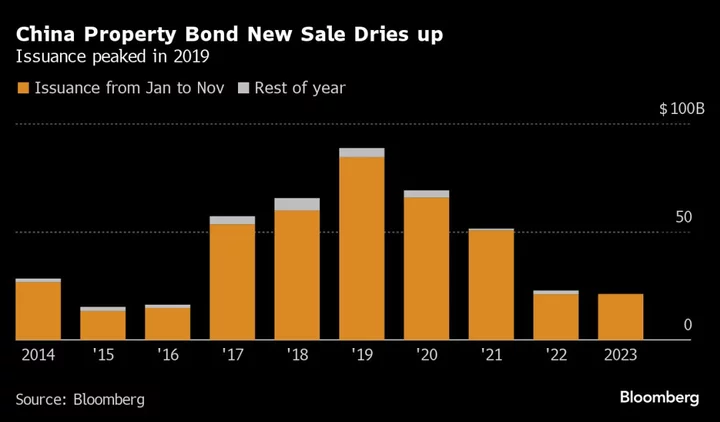

With much of China’s financial world now fixated on the troubles at rivals including China Evergrande Group — which faces potential liquidation in a court hearing on Monday — Sunac represents a glimmer of hope for the $194 billion dollar-bond market for Chinese developers. The company’s rocky path to an agreement, pieced together from accounts by more than 10 people familiar with the negotiations, offers a potential roadmap for dozens of distressed developers.

“Sunac just shows restructuring can be done,” said Richard Ong, co-chairman of RRJ Capital, one of the creditors. “They should be the model for Chinese property companies. The government also needs to put pressure on all the companies who don’t want to get this done.”

Sunac, which declined to comment for this story, needed to restructure $10.2 billion of debt or a cascade of defaults will threaten the survival of what was once China’s third-biggest builder.

At Gao’s second face-to-face meeting in Hong Kong since mainland borders reopened, he suggested to bondholders including PAG and Pacific Investment Management Co. that the afternoon session should be scrapped unless they intend to complete negotiations.

The CFO’s about-turn paved the way for the basis of a restructuring deal by around 5 pm. They met again on Feb. 28 to seal terms. Just weeks after that, more than 75% of offshore creditors had signed on the deal. The company won court approval for the plan in October and its restructuring became effective on Nov. 20.

Trouble had long been brewing as Sunac’s aggressive expansion — which included buying theme parks — made it the country’s most-indebted developer in 2017. As financing from banks dried up and home sales slowed, it defaulted on a dollar note in May 2022.

By then, the firm had more than one trillion yuan ($140 billion) of liabilities.

Differences with creditors were wide in talks conducted online in 2022, the people said, asking not to be identified to preserve relationships. Sunac had proposed swapping some debt for equity at a conversion price of HK$20 a share, an offer creditors rejected outright with stock trading halted at under HK$5, the people said.

PJT Partners Inc. and Linklaters LLP advised the ad-hoc group of nine major creditors, which held offshore unsecured liabilities. They included Ashmore Group plc, AM Squared Ltd, Barings LLC, Broad Peak Investment Advisers Pte Ltd, Contrarian Capital Management, and Varde Partners.

AM Squared, Ashmore, Barings, Contrarian, Linklaters, and Pimco declined to comment.

Gao, a company man who joined Sunac in 2007, would gradually come to terms with creditors. A key motivation was the developer’s desire to get rid of the defaulter label because it’ll then get better prices for its assets and be more likely to gain state support, the people said, citing conversations with the CFO.

To win over the bondholders, Chairman Sun Hongbin, whose $450 million loan was part of the debt under restructuring, would be given the same terms, according to the people. In the end, Sunac and the creditors agreed to a debt-to-equity conversion, while bondholders decided to extend repayment to as long as nine years, from the seven years initially proposed, the people said.

“They were very open as well in terms of willing to consider all options,” said RRJ’s Ong. By actively engaging with creditors, Sunac has built trust, which will help with future fund-raising efforts, he said.

The deal was noteworthy because it reduced Sunac’s debt, instead of just bond payment extensions as commonly in other talks, with Sun’s stake diluted to under 25% from almost 40%, according to S&P Global Ratings.

“As bondholders, we are more than willing to work cooperatively with companies like Sunac which has been proactive in its approach toward finding a solution that takes into account the challenges faced by the property sector in China but at the same time, balances the interests of the bondholders and other stakeholders,” said Sandeep Gupta, managing director at Broad Peak Investment Advisers Pte Ltd.

White List

In a sign that Beijing wants to put a floor to the distressed sector, regulators are drafting a list of 50 developers eligible for a range of financing, Bloomberg reported Nov. 20. It’s not known if Sunac is on the list.

While the news sent developer stocks rallying, bonds of distressed companies were largely unchanged, an indication of the pessimism among creditors. All the bonds of Evergrande are trading under less than two cents on the dollar, while Sunac’s newly-issued debt are at between nine cents to 16 cents on the dollar, according to Bloomberg-compiled data.

Still, other developers are following in the footsteps of Sunac. Yuzhou Group Holdings Co. may finalize a debt restructuring plan in months, people familiar with the discussions said. Yuzhou didn’t reply to Bloomberg’s query. China Aoyuan Group said it obtained sufficient support from creditors on Tuesday for a restructuring plan.

Sunac, however, still faces the fraught challenge of generating steady cash flows in a market where demand for homes has plummeted. It needs to achieve at least 15 billion yuan in monthly sales, said Xu Liqiang, fixed income deputy director from Shanghai Silver Leaf Investment Co., citing a presentation made in July.

The company posted just 4.76 billion yuan in contracted sales for October.

Sunac will probably get on the list for state support, which may “create a positive feedback loop on its home sales and funding access,” said Zerlina Zeng, senior credit analyst with CreditSights. “That said, for the company to survive and thrive over the longer term, we still need to see a more sustained recovery of home sales and a stabilizing of prices in the secondary markets.”

--With assistance from Emma Dong.