China’s factories look to have stabilized for now, though the recovery has been far from swift and the momentum for growth may be in trouble without more policy support.

An official gauge of manufacturing activity returned to expansion in September for the first time in six months, a sign that stimulus may be taking root. But it’s not all smooth sailing: That index just barely cleared the dividing line between contraction and growth from the prior month, while a private gauge of activity in the sector underperformed and suggested the recovery isn’t on solid ground just yet.

“The macro economy has shown signs of stabilization,” said Wang Zhe, senior economist at Caixin Insight Group, in a statement accompanying data showing the rate of expansion in factory activity slowing in September. “However, the economic recovery has yet to find a solid footing, with insufficient domestic demand, external uncertainties and pressure on the job market.”

The data adds up to a precarious outlook for the world’s second-largest economy, which is trying to regain traction amid challenges from weak consumer and business confidence along with the ongoing property crisis. China has rolled out stimulus including cutting bank reserve requirements, slashing interest rates and easing home-purchase requirements.

The private purchasing managers’ index from Caixin and S&P Global was evidence of how shaky things still look. Pickups in supply and demand were offset by employment pressures and weak overseas orders. The Caixin gauge surveys more export-oriented firms than the official one does.

What Bloomberg Economics Says

“The surprise drop in the Caixin manufacturing PMI in September signals parts of China’s economy remain fragile. The decline bucked a pickup in gauges in the official survey. The Caixin setback suggests private businesses and exporters are still under heavy pressure.”

— Eric Zhu, economist

Read the full report here.

An average of the official and private manufacturing surveys “is consistent with factory activity remaining largely unchanged last month,” said Sheana Yue, China economist at Capital Economics, adding that impacts from fiscal policy “could also prove short-lived.”

The slow recovery in China is clouding the outlook for global growth as central banks worldwide fight to tackle inflation. Data published on Monday showed manufacturing activity across Asia mostly worsened in September, undercutting cautious optimism that the global economy is finding itself on steadier footing.

Services Slowdown

The weekend’s PMI data also suggested services activity is somewhat constrained. An official survey of the services sector picked up a bit to 50.9 in September, but the Caixin index eased significantly to 50.2 — the lowest rate of expansion all year.

“Surveyed companies indicate that the slowdown in business activity was related to weaker-than-expected demand,” Goldman Sachs Group Inc. economists wrote in a research note Sunday. Soft readings for both the official and private services indexes were caused “potentially on a combination of fading reopening boost and weakening property market,” they added.

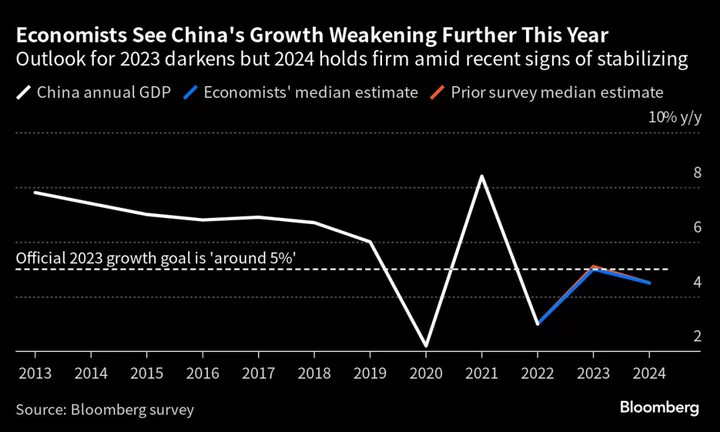

The real estate industry has been in turmoil for years, and economists in a recent Bloomberg survey see the sector posing the nation’s biggest challenge right now. They expect China will just about meet its economic growth target of around 5% for this year, with property raising the risk of a miss.

China is currently on an eight-day holiday called Golden Week, which is historically a key test for the property sector. After the nation’s home sales moderated their decline in September following stepped-up efforts to support housing, developers are now looking to see if the holiday sparks the revival they’re looking for.

Bloomberg Economics sees the need for more policy support to lift consumption and help the property market, and expect the central bank to lower a key rate and cut the reserve requirement ratio again to free up more funds for banks to lend.

The real estate sector’s downward spiral, weak exports and low private sector confidence may also mean economic conditions remain poor or even worsen in the coming months, according to Nomura Holdings Inc. economists including Lu Ting.

“Despite signs of stabilization, we remain cautious on growth,” they wrote in a research note. “Recent signs of stabilization may also slow Beijing’s efforts in rolling out the measures necessary to truly stabilize the economy, especially for the property sector.”