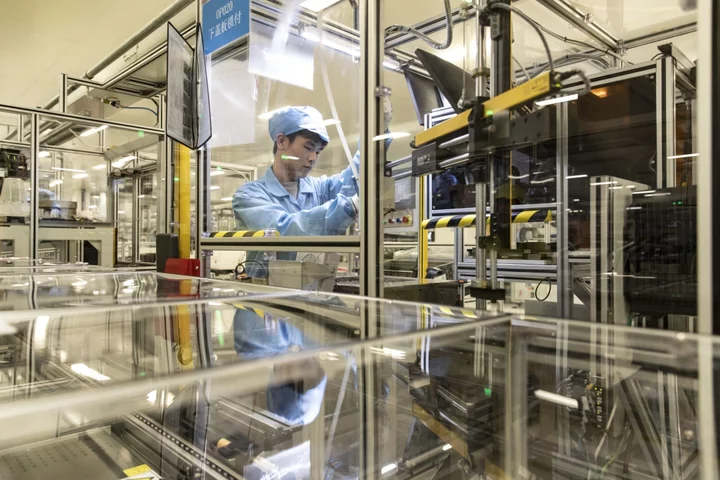

Two surveys suggest China’s manufacturing sector improved or at least stabilized in May compared with the previous month, providing some respite following signs of a slowdown in the economy’s recovery.

China Beige Book, a US-based data provider, said its surveys show manufacturing output increased “notably” in May from April, as did domestic and foreign orders. Separately, Goldman Sachs Group Inc. cited a pick up in the emerging industries purchasing managers’ index.

“It’s still too early to put a nail in the coffin of the post-Covid Zero recovery,” China Beige Book said in a statement. “Manufacturing activity defied rumors of demise, though soft demand from Western economies remains a major headwind.”

Revenue and profit margins for Chinese manufacturers as well as the service and retail sectors also increased in May from the previous month, it said. China Beige Book’s data was based on a survey of about 1,000 Chinese firms conducted between May 18-25.

Economists are closely scrutinizing Chinese economic releases after April’s data widely missed forecasts, causing several investment banks to downgrade their projections for GDP growth this year closer to the government’s official target of about 5%. Investors have turned more bearish on Chinese stocks, with the Hang Seng China Enterprises Index dropping about 20% from its Jan. 27 peak.

Robin Xing, chief China economist at Morgan Stanley, remained optimistic about China’s growth trajectory for the year despite the softer data last month.

“I would see recent April data weakness as a hiccup,” he said in an interview with Bloomberg TV, adding that the strength in services spending limits any need for additional stimulus. “As we have witnessed in other Asian economies who didn’t use paychecks or fiscal transfers to jump start the recovery, the recovery takes time because you need the service sector to recreate jobs,” he said.

Manufacturing Activity

China’s emerging industries PMI, which measures month-on-month changes in activity in sectors such as renewable energy, advanced manufacturing and biotech, showed an uptick in May compared to the previous month after seasonal adjustment, Goldman Sachs’s China economist Hui Shan said in a note.

The EPMI is widely seen as a leading indicator of China’s official manufacturing PMI, and the figures suggest “a tentative sign that manufacturing activity may begin to stabilize,” Hui added.

She expects the official PMI, which is set to be released on Wednesday, to increase from 49.2 in April to 49.8 in May. The consensus of economists is for a reading of 49.5. Any reading below 50 represents a contraction in activity from the previous month.

The housing market remains a concern, with the Beige Book survey finding weakness in the sector.

“Construction is continuing to struggle,” Shehzad Qazi, managing director of the survey company said in an interview on Bloomberg Radio. “The property market recovery remains incredibly uneven. Price growth rebounded from April but sales slowed.”

Official data has shown a strong recovery in services spending like dining out and travel. That could lead to a tighter job market, which would improve household confidence.

(Updates with comments from economists, market reaction.)