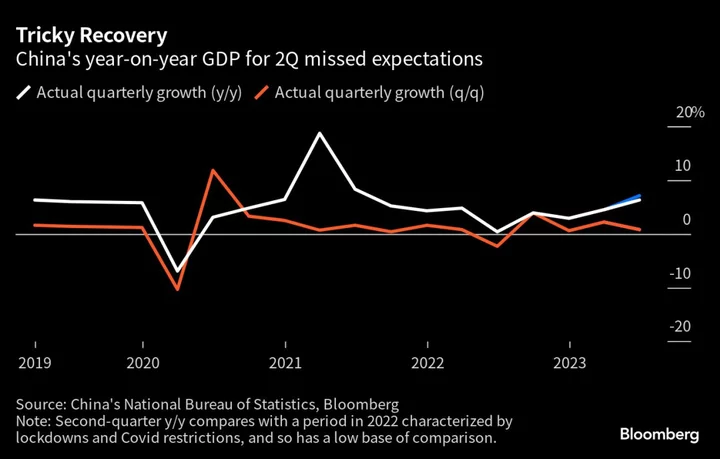

China’s economy grew slower than expected in the second quarter, with consumer spending easing notably in June, sending more alarm bells about the recovery.

Gross domestic product expanded 6.3% in the second quarter from a year prior, data released by the National Bureau of Statistics showed Monday, weaker than the median forecast of 7.1% by economists surveyed by Bloomberg. The figures were distorted by a low base of comparison last year when Shanghai and other places were in lockdown.

Compared to the first quarter, GDP grew 0.8%, in line with economists’ forecasts.

In June alone, activity indicators showed a mixed picture of the economy:

- Retail sales growth slowed to 3.1% from 12.7% in May, missing economists’ prediction for a 3.3% jump

- Industrial output rose 4.4%, compared with a projection of 2.5%, and up from 3.5% in May

- Fixed-asset investment gained 3.8% in the first six months of the year from a year earlier, down from 4% in the January-May period, but higher than the 3.4% forecast by economists

- The urban jobless rate was unchanged at 5.2%

Beijing has set a moderate GDP growth target of around 5% for this year, but is contending with a barrage of economic challenges including the looming prospect of deflation, falling exports and a weakening property market. Pressure is building on policymakers to add more stimulus to the economy, including central bank interest rate cuts and further easing of property controls.

The People’s Bank of China refrained from easing policy on Monday, leaving the rate on its one-year policy loans unchanged at 2.65%, in line with economists’ expectations. Many expect the PBOC to lower the rate in coming months.

Rising US interest rates and high debt levels in the Chinese economy have limited the central bank’s scope to carry out aggressive easing measures. Some economists also argue that weak business and consumer confidence have reduced the effectiveness of monetary stimulus, calling for fiscal policy to play a bigger role in the economy.

Investors are looking to a likely meeting of the Communist Party’s top decision-making body later in July to provide crucial clues on economic policies going forward.

--With assistance from James Mayger and Fran Wang.