China delivered its strongest ever pushback against a weaker yuan via its daily reference rate, as it sought to repair broken confidence in a market spooked by disappointing data and heightened credit risks.

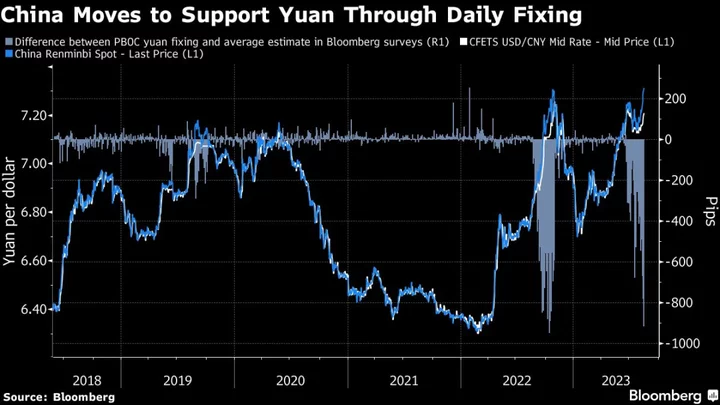

The People’s Bank of China set its so-called fixing at 7.2006 per dollar compared to an average estimate of 7.3047 in a Bloomberg survey with traders and analysts. That was the largest gap to estimates since the poll was initiated in 2018.

The offshore yuan extended gains to 0.2% after the fixing, which was also set at a stronger level to the previous day for the first time in six sessions.

“At this juncture, the PBOC might want to put a stop in the trend,” of a weaker yuan, said Kiyong Seong, lead Asia macro strategist for Societe Generale SA. “On a temporary basis, it’s possible the actions by policy makers can discourage more bearish betting.”

Authorities have been escalating their support for the embattled yuan over the past week, only to see it sinking in both onshore and overseas markets to multi-year lows. They told state-owned banks to step up intervention, according to people familiar with the matter, and the central bank said it will resolutely prevent excessive adjustment in the yuan.

That request came as the yuan fell toward 7.35 per dollar, a level that top leadership has been paying close attention to, the people said. The yuan traded around the 7.29 level offshore on Friday.

“Going ahead, further measures such as potential cut to the foreign-exchange reserve-requirement ratio following the PBOC’s pledge to prevent overshoooting may prompt yuan bears to trim their short position,” said Ken Cheung, chief Asian FX strategist at Mizuho Bank Ltd. in Hong Kong.

China Told State Banks to Escalate Yuan Intervention

The problem for China is that yuan bears had latched on to the fact that the fixing itself had been progressively weaker over the past weeks, regardless of its gap to estimates, and taken that as a sign the PBOC is ok with a slow depreciation in the currency. Underwhelming economic data in retail sales and housing prices, coupled with a spreading crisis in the property sector, are also weighing on sentiment.

“The PBOC has persisted in setting the fixings much stronger than expected, with the largest counter-cyclical factor since late last year, but they have been allowing the yuan to adjust,” Australia & New Zealand Banking Group strategists including Mahjabeen Zaman wrote in a note Thursday. “This is a sign that the authorities are prioritizing the need to support growth at the expense of the currency.”

China’s currency has tumbled over 5% against the dollar this year amid a disappointing economic recovery and broad dollar strength. PBOC rate cuts to re-ignite growth have just intensified the focus on the widening US-China yield gap and added more pressure to the yuan.

The foreign-exchange market is currently in line with fundamentals, the PBOC said in its monetary policy report.

“The authorities are preparing to draw a line in the sand and defend the currency from further weakness,” said Khoon Goh, head of Asia research at Australian & New Zealand Banking Group in Singapore. “But for a more sustained rebound in the yuan, we really need to see US 10-year bond yields come down from current high levels.”

(Updates with comments)