China is encouraging private firms to invest in key industries like transportation and advanced manufacturing in Beijing’s latest efforts to revive the faltering economy.

The National Development and Reform Commission released a plan on Monday highlighting the importance of investment by private companies. The move followed a rare joint statement last week by the Communist Party and the government pledging to improve the business environment.

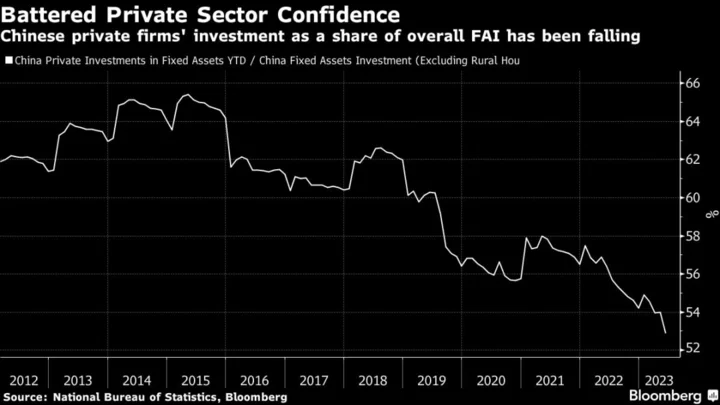

The government will strive to maintain the share of private investment in overall fixed-asset investment at a “reasonable” level, the NDRC, the country’s top economic-planning agency, said in a statement.

Key sectors where private investment is encouraged include transportation, water conservation, clean energy, new infrastructures, advanced manufacturing and modern agricultural facilities. Local authorities will create lists of major projects, key supply chain projects and franchise projects that are fully user-paid for private investment, the NDRC said. It will also build a project platform for the companies to access information more easily, it said.

Private investment in China has contracted this year as businesses, already battered by years of pandemic controls and regulatory crackdowns in key sectors like property and technology, now grapple with a slowing recovery. Top leaders and government officials have met with several high-level business executives this year — including with global funds on Friday — in a bid to turn around sentiment. Yet investors remain skeptical about the pledges.

The NDRC said it’s plan is intended to “further deepen, flesh out and specify the measures to continuously strengthen the willingness and ability of private firms to invest.” It repeated the government’s language on “unwavering” support for the sector.

The NDRC will also recommend projects in a national key private investment project bank for funding support from financial institutions, and enhance coordination with policy and commercial lenders as part of efforts to address the financing difficulties at the companies, it said.

Qualified private investment projects will be supported to issue infrastructure real estate investment trust products to expand the financing channels of private companies, lower their debt-to-asset ratio and improve their ability to reinvest, it added.

The private sector produces more than 60% of China’s gross domestic product and accounts for more than 80% of urban jobs. However, the sector’s investment made up just 53% of overall fixed assets investment as of the end of June, down from a peak of 65% in May 2015, according to Bloomberg calculations of official data.