China’s decision to restrict critical mineral exports will hit critical sectors in the European Union’s effort to decarbonize its economy, and demonstrates the limits of western aspirations to shift supply chains beyond the reach of policymakers in Beijing.

China is the largest global producer of the two minerals, gallium and germanium, which will be subject to export restrictions next month and that are crucial to the semiconductor, telecommunications and electric-vehicle industries. The EU gets 71% of its gallium from China and 45% of its germanium.

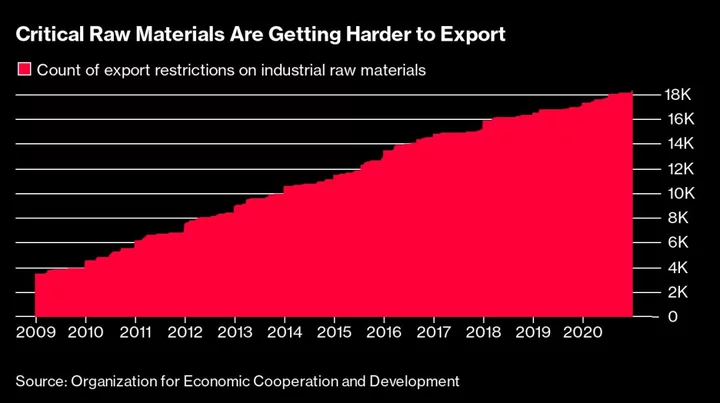

The move comes weeks after the EU unveiled a new economic security strategy, which seeks oversight of critical technology exports and may curb outbound investments in the name of national security. The proposal is part of a growing push within the bloc to strengthen security tools as countries such as China and Russia increasingly use trade and the control of critical supply lines to advance political and even military goals.

“China’s action is a stark reminder of who has the upper hand in this game,” Simone Tagliapietra, a researcher at the Bruegel think-tank in Brussels, said in an interview. “The harsh reality is that the west will need at least a decade to de-risk from China’s minerals supply chains, so this really is an asymmetric dependency.”

The EU was taught a difficult lesson when Russia invaded Ukraine last year, triggering surging inflation and fears that entire industries might collapse as the bloc rushed to source new supplies of oil and gas. The bloc’s member states were torn over how to respond to Moscow, with some countries overly reliant on cheap Russian crude and gas.

The same dynamic is also playing out with the EU’s policy on China, with certain nations unwilling to put their trade relationship with the world’s second-largest economy at risk.

China’s $6.8 trillion consumer marketplace is a critical destination for European exports of cars, pharmaceuticals and machinery. German automakers Volkswagen AG, Mercedes-Benz AG and Bayerische Motoren Werke AG have built dozens of factories in China and all three manufacturers now sell more vehicles in China than any other market.

The US has pushed for Europe to take a tough line with Beijing, and European Commission President Ursula von der Leyen has argued that the bloc needs to “de-risk” from China, but short of a full-blown “decoupling.”

The EU launched its Critical Raw Materials Act in March to ease financing and permitting for new mining and refining projects and strike trade alliances to reduce the bloc’s dependence on Chinese suppliers. The US and Europe have also been looking to set up a “buyers’ club” to strike supply deals and investment partnerships with producing nations.

“We have seen a very deliberate hardening of China’s overall strategic posture for some time and it has now been matched by a ratcheting up of increasingly assertive actions,” von der Leyen said in a policy speech earlier this year. “Just as China has been ramping up its military posture, it has also ramped up its policies of disinformation and economic and trade coercion.”

And member states have been taking even stronger measures. The Dutch government announced last week measures that will prevent ASML Holding NV — a company with a near-monopoly on the machines needed to make the most advanced semiconductors — from selling some of its equipment to China.

WTO Complaint

The commission, the EU’s executive arm, could confront China’s new export restrictions via dispute settlement proceedings at the Geneva-based World Trade Organization.

However, such a dispute could take years to wind its way through the WTO’s partially dysfunctional dispute settlement body. Furthermore, China’s claim that the measures are necessary for national security could trigger a WTO loophole that allows governments to take “any action which it considers necessary for the protection of its essential security interests.”

But more immediate for the EU, an escalation of tensions could threaten the bloc’s ability to transform its economy to become more environmentally friendly.

The Chinese move comes as the EU is embarking upon an unprecedented overhaul to eliminate carbon emissions across its entire economy, from energy production to agriculture and transport. The Green Deal, whose target is to make the region climate-neutral by 2050, will require access to massive amounts of critical materials used in everything from solar panels to electric vehicles.

“Europe today largely depends on China for a set of clean technologies and critical components, so an escalation of these tensions might make Europe’s green transition more bumpy for sure,” Tagliapietra said.

--With assistance from Alberto Nardelli.

Author: Ewa Krukowska, Bryce Baschuk and Richard Bravo