China’s tech sector has a new obsession: competing with US titans like Google and Microsoft Corp. in the breakneck global artificial intelligence race.

Billionaire entrepreneurs, mid-level engineers and veterans of foreign firms alike now harbor a remarkably consistent ambition: to outdo China's geopolitical rival in a technology that may determine the global power stakes. Among them is internet mogul Wang Xiaochuan, who entered the field after OpenAI’s ChatGPT debuted to a social media firestorm in November. He joins the ranks of Chinese scientists, programmers and financiers — including former employees of ByteDance Ltd., e-commerce platform JD.com Inc. and Google — expected to propel some $15 billion of spending on AI technology this year.

For Wang, who founded the search engine Sogou that Tencent Holdings Ltd. bought out in a $3.5 billion deal less than two years ago, the opportunity came fast. By April, the computer science graduate had already set up his own startup and secured $50 million in seed capital. He reached out to former subordinates at Sogou, many of whom he convinced to come on board. By June, his firm had launched an open-source large language model and it’s already in use by researchers at China’s two most prominent universities.

“We all heard the sound of the starter pistol in the race. Tech companies, big or small, are all on the same starting line,” Wang, who named his startup Baichuan or “A Hundred Rivers,” told Bloomberg News. “China is still three years behind the US, but we may not need three years to catch up.”

The Tech Behind Those Amazing, Flawed New Chatbots: QuickTake

The top-flight Chinese talent and financing flowing into AI mirrors a wave of activity convulsing Silicon Valley, which has deep implications for Beijing’s escalating conflict with Washington. Analysts and executives believe AI will shape the technology leaders of the future, much like the internet and smartphone created a corps of global titans. Moreover, it could propel applications from supercomputing to military prowess — potentially tilting the geopolitical balance.

China is a vastly different landscape — one reined in by US tech sanctions, regulators’ data and censorship demands, and Western distrust that limits the international expansion of its national champions. All that will make it harder to play catch-up with the US.

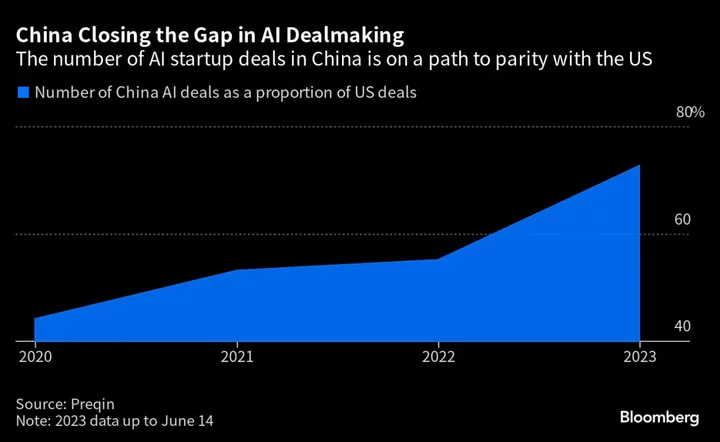

AI investments in the US dwarf that of China, totaling $26.6 billion in the year to mid-June versus China’s $4 billion, according to previously unreported data collated by consultancy Preqin.

Yet that gap is already gradually narrowing, at least in terms of deal flow. The number of Chinese venture deals in AI comprised more than two-thirds of the US total of about 447 in the year to mid-June, versus about 50% over the previous two years. China-based AI venture deals also outpaced consumer tech in 2022 and early 2023, according to Preqin.

All this is not lost on Beijing. Xi Jinping’s administration realizes that AI, much like semiconductors, will be critical to maintaining China’s ascendancy and is likely to mobilize the nation’s resources to drive advances. While startup investment cratered during the years Beijing went after tech giants and “reckless expansion of capital,” the feeling is the Party encourages AI exploration.

It’s a familiar challenge for Chinese tech players.

During the mobile era, a generation of startups led by Tencent, Alibaba Group Holding Ltd. and TikTok-owner ByteDance built an industry that could genuinely rival Silicon Valley. It helped that Facebook, YouTube and WhatsApp were shut out of the booming market of 1.4 billion people. At one point in 2018, venture capital funding in China was even on track to surpass that of the US — until the trade war exacerbated an economic downturn. That situation, where local firms thrive when US rivals are absent, is likely to play out once more in an AI arena from which ChatGPT and Google’s Bard are effectively barred.

Large AI models could eventually behave much like the smartphone operating systems Android and iOS, which provided the infrastructure or platforms on which Tencent, ByteDance and Ant Group Co. broke new ground: in social media with WeChat, video with Douyin and Tiktok, and payments with Alipay. The idea is that generative AI services could speed the emergence of new platforms to host a wave of revolutionary apps for businesses and consumers.

That’s a potential gold mine for an industry just emerging from the trauma of Xi’s two-year internet crackdown, which starved tech companies of the heady growth of years past. No one today wants to miss out on what Nvidia Corp. CEO Jensen Huang called the “iPhone moment” of their generation.

“This is an AI arms race going on both in the US and China,” said Daniel Ives, a senior analyst at Wedbush Securities. “China tech is dealing with a stricter regulatory environment around AI, which puts one hand behind the back in this ‘Game of Thrones’ battle. This is an $800 billion market opportunity globally over the next decade we estimate around AI, and we are only on the very early stages.”

Read more about the US-China AI war:

- Xi Remade China's Tech Industry in His Own Image With Crackdown

- Baidu Leads China AI Rally After Chat Bot Scores Strong Reviews

- AI Unicorns Are Everywhere and Their Founders Are Getting Rich

- How China Aims to Counter US Efforts at ‘Containment’: QuickTake

The resolve to catch OpenAI is apparent in the seemingly haphazard fashion in which incumbents from Baidu Inc. and SenseTime Group Inc. to Alibaba have trotted out AI bots in the span of months.

Joining them are some of the biggest names in the industry. Their ranks include Wang Changhu, the former director of ByteDance’s AI Lab; Zhou Bowen, ex-president of JD.com Inc.’s AI and cloud computing division; Meituan co-founder Wang Huiwen and current boss Wang Xing; and venture capitalist Kai-fu Lee, who made his name backing Baidu.

Ex-Baidu President Zhang Yaqin, now dean of Tsinghua University’s Institute for AI Industry Research and overseer of a number of budding projects, told Chinese media in March that investors sought him out almost daily that month. He estimates there’re as many as 50 firms working on large language models across the country. Wang Changhu, former lead researcher at Microsoft Research before he joined Bytedance in 2017, said dozens of investors approached him on WeChat in a single day when he was preparing to set up his generative AI startup.

“This is at least a once-in-a-decade opportunity, an opportunity for startups to create companies comparable to the behemoths,” Wang told Bloomberg News.

Many of the fledgling firms are squarely aimed at the home crowd, given growing concern in the West about Chinese technology. Even so, there’s an open field in a consumer market ringfenced to themselves, which also happens to be the world’s largest internet arena. In the works are AI-fueled applications, from a chatbot to help manufacturers track consumption trends, to an intelligent operating system offering companionship to counter depression, and smart enterprise tools to transcribe and analyze meetings.

Still, Chinese demos so far make it clear that most have a long way to go. The skeptical point out true innovation requires the free-wheeling exploration and experimentation that the US cultivates but is restrained in China. Pervasive censorship in turn means the datasets that China’s aspirants are using are inherently flawed and artificially constrained, they argue.

“Investors are chasing the concept,” said Grant Pan, chief financial officer of Noah Holdings, whose subsidiary Gopher invests in over 100 funds including Sequoia China (now HongShan) and ZhenFund in China. “However, the commercial use and impact to industry chains are not clear yet.”

Then there are Beijing’s regulations on generative AI, with its top internet overseer signaling that the onus for training algorithms and implementing censorship will fall on platform providers.

“Beijing’s censorship regime will put China’s ChatGPT-like applications at a serious disadvantage vis-à-vis their US peers,” said Xiaomeng Lu, director of the Eurasia Group’s geotechnology practice.

Last but not least, powerful chipsets from the likes of Nvidia and Advanced Micro Devices Inc. are crucial in training large AI models — but Washington bars those from the country.

But these hurdles haven’t stopped the ambitious in China, from Baidu and iFlytek Co. to the slew of new startups, from setting their sights on matching and surpassing the US on AI.

Executives, including from Tencent, argue models can tack on more chipsets to make up for lesser performance. Baichuan’s Wang says it gets by with Nvidia’s A800 chips, and will obtain more capable H800s in June.

Others like Lan Zhenzhong, a veteran of Google’s AI Research Institute who founded Hangzhou-based Westlake Xinchen in 2021, employ a costly hybrid approach. The Baidu Ventures-backed company uses fewer than 1,000 GPUs for model training, then deploys domestic cloud services for inference, or sustaining the program. Lan said it cost about 7 to 8 yuan per hour to rent an A100 chip from cloud services: “Very expensive.”

Billionaire Baidu founder Robin Li, who in March unfurled China’s first answer to ChatGPT, has said the US and China both account for roughly a third of the world’s computing power. But that alone won’t make the difference because “innovation is not something you can buy.”

“Why aren’t people willing to invest in the longer-term and dream big?” asked Wayne Shiong, a partner at China Growth Capital. “Now that we’ve been handed this assignment by the other side, China will be able to play catch-up.”

--With assistance from Zheping Huang and Vlad Savov.