China’s economic activity probably faltered in October, with numbers that look good relative to last year seen masking a slowdown in activity headed into the final months of 2023.

That dynamic will be most evident in retail sales data, which is expected to show a 7% jump year-on-year as it compares to pandemic and lockdown-hit 2022. But economists see activity possibly slowing from September, as other indicators have shown consumer demand and confidence losing momentum. Growth in fixed-asset investment and industrial production, meanwhile, was likely flat.

That all adds up to softening momentum for the recovery, which authorities have already tried to support through unconventional fiscal stimulus that led to a rare mid-year revision to the government budget.

On the monetary policy side, the central bank’s options to help the economy are fairly limited given yuan weakness and pressures on capital outflows: Policymakers are expected to hold steady a key policy interest rate this week, though they may inject more cash into the financial system. They may also soon cut the amount of cash banks have to keep in reserve in a bid to keep liquidity ample.

“The economy is stabilizing under the efforts from various policies, but economic data may still appear turbulent,” said Zhaopeng Xing, senior China strategist at Australia & New Zealand Banking Group Ltd. He said the base effects that are painting a better picture for the year-on-year data will likely boost those figures into January.

Earlier figures have already shown muted activity. Aside from weak manufacturing and export data, credit figures on Monday showed weak business and household borrowing, as well as a large contraction in shadow financing. US Treasury Secretary Janet Yellen said this week she discussed China’s growth slowdown with finance ministers from across the Pacific Rim as they met for the APEC summit in San Francisco, adding that they agreed the issue presented a “downside risk” to the region’s outlook.

Chinese Finance Minister Lan Fo’an, though, said at the ministers’ meeting that he expects the economy to maintain its momentum in the fourth quarter, according to a readout from his ministry.

The National Bureau of Statistics is expected to release October economic data Wednesday at 10 a.m. local time. Here’s what to watch:

Retail Sales

Retail sales are projected to have expanded 7% from October 2022, according to the Bloomberg survey — a notable pickup from the 5.5% year-on-year gain recorded in September.

That figure would be heavily skewed, though, by the comparison to last year. Covid outbreaks and lockdown measures led to a contraction in consumer spending in October 2022. This time around, an eight-day Golden Week holiday at the beginning of the month also likely helped the data as travel and spending surged.

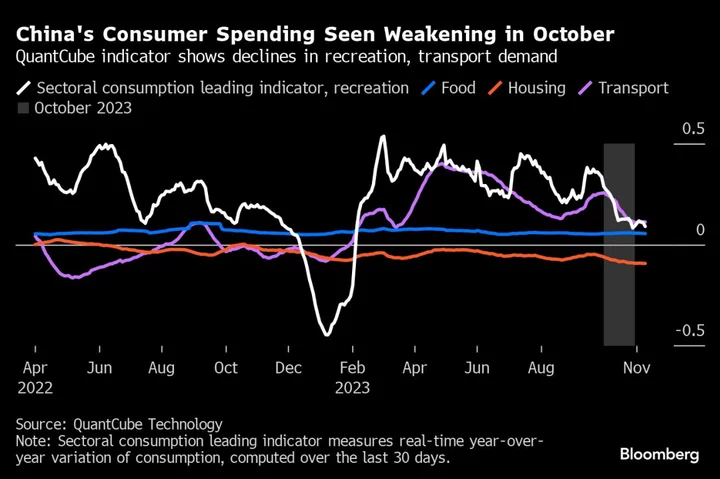

That doesn’t necessarily mean consumption is on stable ground. Independent surveys and alternative data showed a slowdown in consumer demand for recreation and transport in October, along a drop in consumer sentiment. Official and private surveys have also suggested that grown in services activity was weak, while consumer prices dropped into deflation.

Goldman Sachs Group Inc. economists expect retail sales growth for October to imply a 0.5% drop in month-over-month annualized terms, adding in a recent research note that “growth appears to be hitting a soft patch.”

Industrial Production

Industrial output is estimated to have increased 4.5% in October from a year ago, a rate of expansion that would be unchanged from both September and August.

China’s factories have shown signs of trouble recently, with manufacturing activity unexpectedly contracting in official and private surveys. Exports also dropped more than expected in the month, suggesting that global demand for Chinese goods has struggled to gain traction.

“Judging from the disappointing October PMIs and soft export growth, we think October sequential activity growth likely slowed from September,” Goldman economists including Rina Jio wrote in a report.

Fixed-Asset Investment

Fixed-asset investment is forecast to have risen 3.1% in the first 10 months of the year from the same period in 2022. That would be flat with the growth rate from January through September.

A large chunk of the government bonds issued in the month was for refinancing “hidden debt” — or off-balance-sheet borrowing — held by local governments, rather than for financing new investment, according to the Goldman economists.

Beijing at the end of October approved the issuance of an additional 1 trillion yuan ($137 billion) worth of sovereign bonds this year to fund projects geared toward disaster relief and climate. That will likely help investment in the coming months.

Policy Rate

The People’s Bank of China is expected to hold the rate on the medium-term lending facility at 2.5% on Wednesday, according to 12 of the 15 economists surveyed by Bloomberg. The rest see the central bank lowering the rate between five and 10 basis points.

The central bank is also projected to offer 950 billion yuan via the MLF, exceeding the 850 billion yuan maturing this month.

The PBOC is keeping monetary policy loose as it works to support growth, but its ability to cut rates has been restricted by external pressures. Lower rates would widen the gap between bond yields in China and the US, which has fueled capital outflows. China recorded the first drop on record in a measure of foreign direct investment in the third quarter, while the onshore yuan hit the weakest level since 2007 earlier this year.

“China is unlikely to cut the MLF rates as the yuan is still facing downward pressure amid expectations of ‘higher for longer’ US rates,” ING Groep NV economists including Robert Carnell wrote in a report published Thursday.

(Updates with APEC details.)