Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

China’s economy lost steam in the second quarter, prompting officials to roll out several measures aimed at reinvigorating demand and heading off deflation.

Gross domestic product grew at a slower-than-expected pace of 6.3% from a year earlier, when dozens of Chinese cities were in lockdown. Compared with the first quarter, GDP rose less than 1%. A measure of economy-wide prices was negative for the first time since 2020.

That stands in contrast to Europe, where core inflation increased last month by more than previously reported.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy:

Asia

China’s economic recovery lost momentum in the second quarter, putting Beijing’s growth target for the year at risk and adding to concerns about a slowdown in the world economy. Deflation is a major risk now, the data showed, with economy-wide prices declining for the first time since 2020, while youth unemployment climbed to above 21%.

Japan’s consumer prices advanced at a faster clip in June in another indication of lingering stickiness in inflation ahead of next week’s Bank of Japan meeting, although economists forecast a slowdown in coming months.

China’s property industry contracted again in the second quarter after a short-lived expansion in the previous three months, adding to the economy’s challenges.

Europe

Euro-area underlying inflation, the key measure of price gains for the European Central Bank, accelerated more than initially reported in June, cementing the interest-rate increase widely expected next week. With headline inflation now having almost halved since its 10.6% peak in October, officials have shifted focus to the narrower measure, which is proving more stubborn.

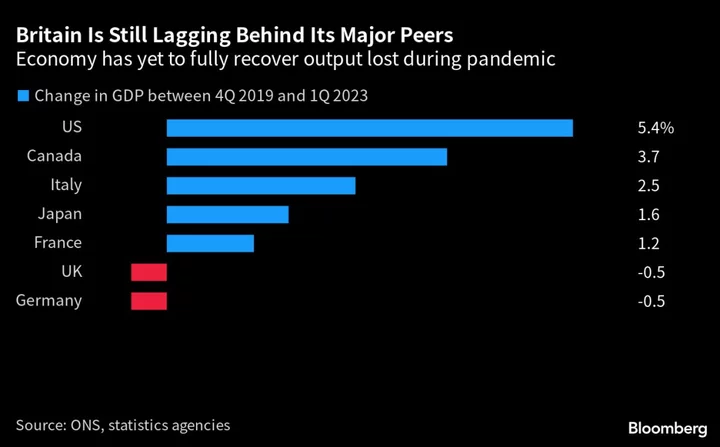

Britain’s inflation rate dropped to the lowest in 15 months, fueling hopes among investors and economists of a shift away from the worst price spiral in the Group of Seven nations.

Britain’s economic growth will fall further behind the euro area next year, and inflation will remain stubbornly high, according to new forecasts that paint a bleak backdrop for the next general election.

US

Retail sales rose by less than forecast, while an underlying measure of household spending pointed to a more resilient consumer at the end of the second quarter. So-called control group sales — which are used to calculate gross domestic product and exclude food services, auto dealers, building materials stores and gasoline stations — climbed 0.6%, twice the prior month’s gain.

For decades, motorists have dealt with miles-long traffic jams and fiery wrecks on the Brent Spence Bridge, a vital link spanning the Ohio River between Cincinnati and Covington, Kentucky. The bridge has served as an archetype of aging US infrastructure. While the project is finally moving forward, the effort risks cost overruns and delays if planners adopt an alternative design for the bridge and its ramps, which aims to reestablish neighborhoods destroyed to make way for a highway leading to the span in the 1950s. Things are further complicated by requirements the Biden administration has enacted that aim to minimize projects’ climate effects, require US-made construction materials and reconnect communities.

More than 650,000 American workers are threatening to go on strike this summer — or have already done so — in an avalanche of union activity not seen in the US in decades.

Emerging Markets

Peru — Latin America’s fastest-growing major economy this century — is facing what was once unthinkable: a technical recession at a time of global growth. The Andean nation’s economy has contracted 0.5% in the first five months of the year, stunning economists and defying the government’s position that “Peru is back” after a period of intense political turmoil.

Argentina posted its worst monthly trade deficit on record in June, underscoring the impact of a record drought that’s driving the economy into a recession.

World

South Africa’s central bank unexpectedly paused its longest phase of monetary tightening since 2006. Turkey surprised as well, with policymakers slowing their pace of interest-rate increases but pledging to amplify their impact on credit markets with alternative measures. Russia raised rates for the first time since emergency measures taken after its invasion of Ukraine.

There’s a more than $500 billion storm of corporate-debt distress that’s already starting to make landfall across the globe, according to data compiled by Bloomberg. The tally is all but certain to grow. And that’s deepening worries on Wall Street by threatening to slow economic growth and strain credit markets just emerging from the deepest losses in decades.

--With assistance from Irina Anghel, Enda Curran, Lucca de Paoli, Josh Eidelson, Patrick Gillespie, Tom Hancock, Jeremy Hill, John Liu, Yujing Liu, Mark Niquette, Yoshiaki Nohara, Reade Pickert, Tom Rees, Marcelo Rochabrun, Zoe Schneeweiss, Fran Wang, Lucy White and Erica Yokoyama.