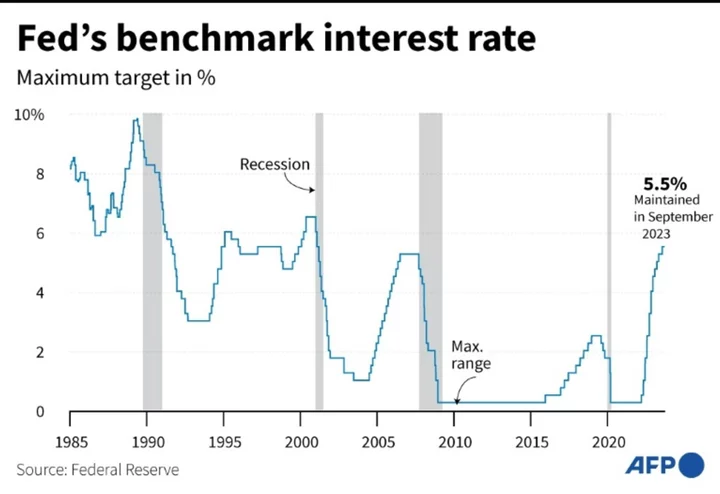

Investors were hoping to hear central banks finally signal this week that they were close to being done raising interest rates in their battle against inflation.

Instead, policymakers indicated that high rates are here for a while yet, with more hikes on the cards and few, if any, cuts in the near future.

The US Federal Reserve set the tone on Wednesday when it paused its rate-hike campaign but caused a stir by leaving the door open to another increase before the end of the year.

The central bank also unsettled investors by saying that only two cuts were expected next year instead of four as anticipated.

The Fed has more room to keep its "hawkish" stance as the US economy has performed better than feared despite the rate increases.

This firm position is shared by other central banks.

Norway's rate hike Thursday was anticipated, but it also warned further tightening was "likely" in December, while ruling out any easing before next year.

- Growth or inflation -

This firm tone came "as a surprise to the markets," which have "decided that the peak" of rate hikes is "happening right now," HSBC economist Fabio Balboni told AFP, even though "central banks' communications leave the door open to the possibility to further hikes".

It leaves "real uncertainty about the level of inflation next year", he said. Their decision "reflects a compromise between growth and inflation", he added.

The rate hikes raise the cost of credit for businesses and consumers, which theoretically in turn reduces demand and inflationary pressures.

But if demand slows too much, it runs the risk of triggering a recession.

Faced with this dilemma, the European Central Bank (ECB) chose inflation-limiting measures, with a 10th consecutive rate hike. That took its benchmark rate to 4.0 percent, the highest since 1999.

"We can't say we have peaked," ECB president Christine Lagarde said, although other officials indicated that the cycle of raising rates might be coming to a close.

"Our future decisions will ensure that the key ECB interest rates will be set at sufficiently restrictive levels for as long as necessary," the bank's chief economist Philip Lane said Thursday in New York.

- Return to lower rates -

There are other signs, however, that rates are reaching their peak.

The Bank of England on Thursday announced its first pause on raising rates since December 2021, following a slight decline in UK inflation in August.

Switzerland and Japan -- like half of all central banks -- have also chosen to halt raising rates in the past 10 days.

"We expect no more rate hikes in the future" for the US, England and Europe central banks, said Balboni.

Jennifer McKeown of Capital Economics said she expected the last hikes to come in the fourth quarter, and that the easing cycle would take hold as 2024 approaches.

"By this time next year, we anticipate that 21 out of the world's 30 major central banks will be cutting interest rates," she wrote.

Although Balboni, taking a more measured stance, said "in the context of weak growth, it will be very complicated to reduce rates" while inflation remains "too high".

Instead, he believes reductions to US rates won't be seen until the third quarter of 2024, while the rest of the world will have to wait until 2025 for rate relief.

cdu/soe/nth/giv/acc/jj