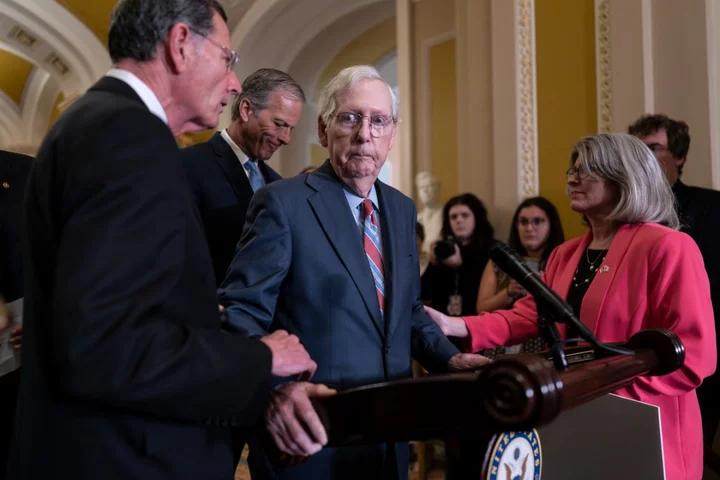

NatWest Group Plc Chief Executive Officer Alison Rose said British customers were gaining confidence, helping the bank keep a positive outlook for the year.

Rose said she saw “quite rational behavior” from borrowers in response to higher interest rates and inflation, including some early mortgage repayments and settlement of more expensive business debt. There have been no material signs of distress among borrowers, she said at Goldman Sachs Group Inc.’s European financials conference in Paris.

Read more: NatWest to Buy £1.3 Billion Shares as UK Continues Sell-Down

She expects the bank’s return on tangible equity to be at the upper end of its medium-term range of 14% to 16% this year, thanks to higher interest rates lifting margins and the resilience of consumers. Still, net interest margins are likely to fall back during the year toward the bank’s guidance of 320 basis points, Rose said, as it passes on a bigger slice of rate rises to savers.

Rose said she was happy about the bank’s growth even in a slower mortgage market, which has been hit by a spike in rates that’s leading banks to raise prices and pull some products. NatWest, the UK’s second-biggest mortgage lender, will “continue to grow that responsibly,” Rose said.