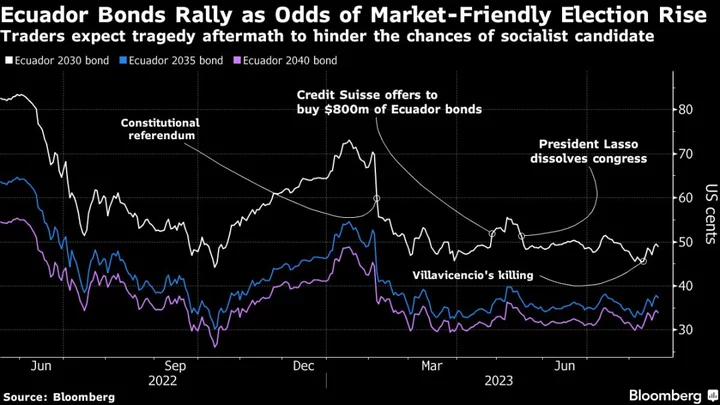

As Ecuadorians prepare to vote for a president Sunday amid its most violent election cycle in memory, investors are betting an unexpected rally in the country’s battered bonds isn’t finished.

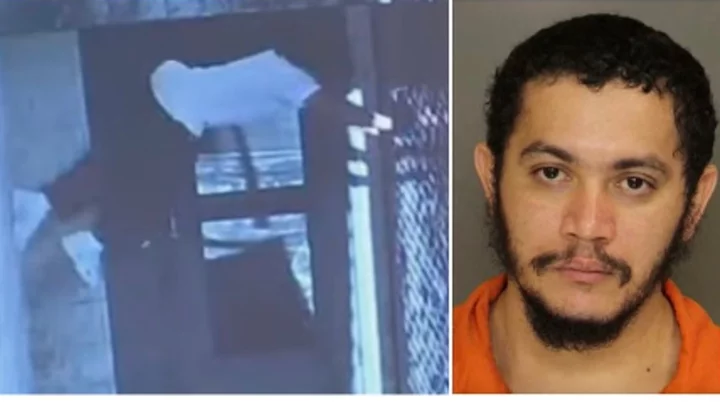

The assassination of presidential candidate Fernando Villavicencio and a shocking rise in crime has made security and stability a focus of the election. That’s raised the chances a conservative, market-friendly candidate will at least make it to a second round in October, and reduces the odds of an outright win by a leftist ally of former President Rafael Correa.

Ecuador’s dollar bonds, in turn, jumped to their highest levels in a month, returning an average of 9% since the murder — compared to a loss of 1.9% across emerging market government bonds. Strategists from Citigroup Inc., JPMorgan Chase & Co. and EMFI Group are among those to recommend buying the debt.

“There could be more upside to the bonds from current prices if a market-friendly candidate makes it to the second round,” said Jared Lou, a money manager at William Blair in New York, who holds the debt. “Recent events highlight the deteriorating security situation in Ecuador.”

The violence adds to political chaos unleashed earlier this year when lawmakers mounted a campaign to impeach President Guillermo Lasso, who responded by dissolving congress, triggering snap elections. A second-round will be held in October if no candidate gets an absolute majority Sunday — or at least 40% of valid votes with a 10 percentage point lead over the runner-up.

In large part, the trade in Ecuador bonds is a bet that whoever wins the presidency will be able to stave off default in the 18 months they will be in office — serving out the remainder of Lasso’s term.

The next large payments on the country’s $15.5 billion of sovereign bonds come due in 2025, the same year the next election will be held. Defaulting would be costly for any party looking to stay in power, said Mauro Favini, a senior portfolio manager at Vanguard, which holds the debt.

“I don’t think any government can govern under default and stay in default and pretend to be a successful economy,” said Favini. “It’s a very shortsighted strategy.”

Still, the country — which has defaulted 11 times since its history — remains highly distressed.

Investors demand an extra 17.5 percentage points of yield to hold Ecuador’s dollar debt, on average, over similar US Treasuries. And the market for credit-default swaps — a type of insurance against default — suggests a 91% chance the government will start missing payments within five years.

“Based on fundamentals it is cheap,” said Ricardo Penfold, a managing director at Seaport, “but that is trumped by politics and their serial defaulters status.”

Even after their recent rally, Ecuador’s bonds have handed investors losses of around 18% this year, the worst performer among emerging markets, according to a Bloomberg index. Fitch Ratings slashed the country’s credit score deeper into junk Wednesday, saying reforms to address Ecuador’s financing challenges won’t go through in the 18-month presidential term.

Most-Likely Scenarios

For investors, a best-case scenario in the first round would be a strong showing by right-wing candidate Jan Topic. He’s seen as the biggest contender for Correa’s hand-picked candidate Luisa Gonzalez, who polls have showed leading the race. It’s also the most likely outcome as Topic’s focus on security has helped him advance in the polls since Villavicencio’s death.

A runoff vote between her and center-right candidate Otto Sonnenholzner or Christian Zurita — the former journalist who’s replacing Villavicencio — would also be welcomed by the market. Investors would fret a runoff between Gonzalez and Indigenous leader Yaku Perez.

“The person who wins this election doesn’t actually matter that much,” said Sarah Glendon, an analyst at Columbia Threadneedle in New York. “They’re not in office long enough to get very much done.”

The composition of congress, where all seats are up for grabs, will be key for the next administration, Glendon said. On top of that, money managers will monitor for a referendum that, if approved, could lead to a 12% drop in the country’s oil output, Fitch estimates.

“The saving grace, at least for the short term, is the technical picture,” Citigroup strategists led by Dirk Willer wrote in a report. “The country maintains a decent fiscal standing and debt payments remain relatively low until 2025, which suggests a restructuring could be avoided in the near term.”

--With assistance from Stephan Kueffner.