The Bank of Korea flagged heightened uncertainty stemming from the Israel-Hamas conflict as it stood pat on policy and stuck to its cautious stance of balancing the risks of elevated inflation and household debt against the need to support economic growth.

The South Korean central bank maintained its seven-day repurchase rate at 3.5% Thursday as forecast by all 18 economists surveyed by Bloomberg. The rate has been unchanged since the policy board last hiked interest rates in January.

While the board has maintained for months a united front on the need to keep open the possibility of raising borrowing costs if needed, Bank of Korea Governor Rhee Chang-yong said at a press briefing after the decision that one member flagged the possibility of also lowering interest rates if required over the next three months.

That’s the first sign of divergence from the BOK’s long-running hawkish threat that it may raise rates if deemed necessary, even though all members still see a chance they may need to raise rates. The decision to hold rates was unanimous, Rhee said.

“Uncertainties regarding economic and inflationary trends have increased across the global economy, driven by a prolongation of restrictive monetary policy stances in major countries and by the Israel-Hamas conflict,” the central bank said in a statement after the decision.

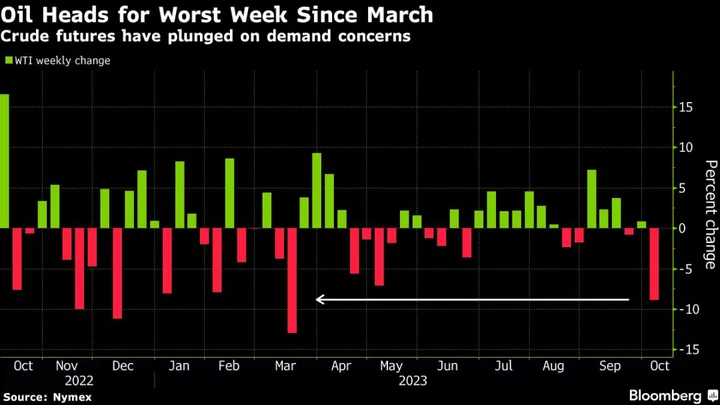

Geopolitical risks will be considered when judging whether rates need to be raised going forward among other factors including inflation, household debt and monetary policy in major overseas economies, the bank said. Rhee added that the conflict could fuel market volatility.

South Korea’s policy sensitive three-year bond yield edged up by about one basis point to 4.1% following the release of the statement. The won was largely unchanged.

The BOK characterizes its own policy as restrictive and reiterated its view that settings would remain that way for a considerable time. The central bank wants to see the inflation rate settle into the 2% range — an outcome it expects to see next year.

Consumer prices advanced 3.7% last month from a year earlier, a quicker pace than the 3.4% recorded in August, but authorities see inflationary pressure easing from this month, with price growth slowing to the low-3% range by year-end. Still, the conflict has increased upside risks for inflation through its impact on oil prices and exchange rates, the bank said.

“We’re likely to see a wait-and-see mode from the BOK at least until the first quarter of next year,” said Kang Seung Won, an analyst at NH Investment & Securities. “There’s little justification yet for the governor to push for change, especially with the Federal Reserve offering no signals that its tightening cycle is over.”

Uncertainty over the outlook for Fed policy gives the BOK another incentive to keep the door open to the possibility of tightening further. While investors expect the Fed to hold rates steady at its meeting concluding on Nov. 1, they also predict US policymakers will refrain from declaring a peak to their tightening cycle.

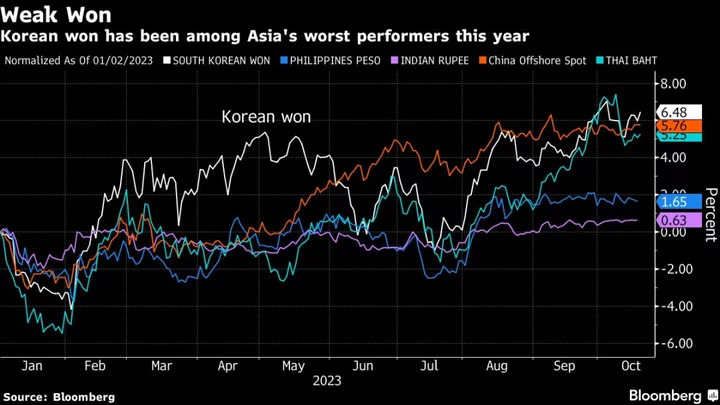

The South Korean won has been one of the worst performers against the dollar during the past month due in part to the yawning rate differential between the two nations.

A resurgence in household debt levels is another concern supporting the case for a hawkish bias, as the central bank considers excessive borrowing a longer-term threat to economic prosperity.

“The BOK isn’t in a position to make any preemptive moves to hike or cut rates in the current circumstances,” said Paik Yoon-min, fixed-income analyst at Kyobo Securities. “Rhee is expected to maintain the bank’s hawkish rhetoric, not because the BOK is set to hike, but to leave some room just in case.”

Still, rising uncertainties about the outlook for economic growth undermine the case for further hikes. Exports continue to contract year on year, while industrial output has fallen for the longest period on record.

What Bloomberg Economics Says...

“Policymakers face elevated uncertainty from the impact of the Israel-Hamas war and the implications of higher US long-term yields. This adverse external environment will make for a more difficult balancing act between supporting the economy and ensuring price and financial stability.”

— Hyosung Kwon, economist

For the full report, click here.

For now, Rhee has expressed a sense of relief over the nascent recovery in semiconductor prices, as the Korean economy is heavily reliant on memory-chip sales. Any improvement in the core drivers of the economy would give the BOK room to keep its rate high for longer if necessary.

--With assistance from Hooyeon Kim, Shinhye Kang and Emily Yamamoto.

(Adds details from BOK Governor Rhee’s press briefing.)