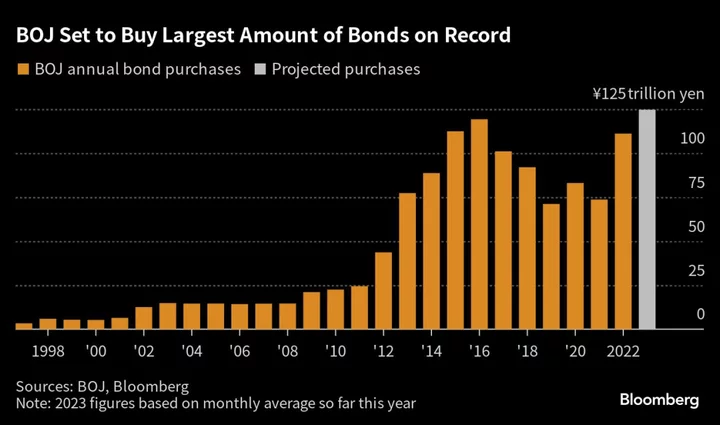

The Bank of Japan is purchasing government bonds at a record pace this year, a factor that likely prompted its recent move to allow larger yield movements to reduce the strain on its control of longer-term interest rates.

Doubling the effective cap on benchmark yields in December and again last month has yet to significantly reduce the BOJ’s bond buying, raising the possibility that more changes will be needed to help rein in purchases.

The increase in buying after each policy tweak also raises the question of whether the BOJ moved too slowly in adjusting its settings, given how aggressively it had to respond to stop investors pushing yields too far.

Calculations by Bloomberg indicate that total buying will reach ¥124.6 trillion ($857 billion) unless market pressure relents and the BOJ is able to scale back its operations. The projected figure is up 12% from 2022, and 4.5% from the previous high in 2016 when the central bank launched yield-curve control to make its stimulus more sustainable by reducing the need to buy JGBs.

Data from the Japan Securities Dealers Association on Monday showed that overseas investors led selling of 10-year Japanese government bonds in July, offloading ¥1.36 trillion, which was the most since January.

“If the BOJ decreases the amount it buys, market participants take that as a sign it’s close to exiting the policy, which boosts yields and forces it to increase the purchases,” said Naomi Muguruma, chief fixed-income strategist at Mitsubishi UFJ Morgan Stanley Securities Co. in Tokyo.

The central bank has had to intervene in the market twice with unscheduled purchase operations since July 28, when it made its latest policy adjustment. Total buying in those two forays to slow sharp yield gains totaled ¥700 billion.

The benchmark 10-year yield reached the highest level since 2014 at 0.655% this month as traders tested the BOJ’s tolerance. Data Friday showed inflation above the central bank’s 2% target for a 16th consecutive month, further emboldening investors who see YCC ending sooner than central bank is prepared to acknowledge.

Concern over China’s economic slowdown and the outlook for US interest rates add to the BOJ’s difficulty in trimming bond purchases, Muguruma said.

The Reserve Bank of Australia’s “disorderly” exit from its own yield-control program suggests a tough period ahead for Japanese policymakers. Debt purchases to defend the RBA target came at a financial cost given the subsequent increase in yields, it said.

“The existence of a yield target under the YCC policy, even with progressive shifts to wider bands and higher ceilings, may not necessarily taper the BOJ’s JGB purchases,” Stephen Chiu, chief Asia foreign-exchange and rates strategist at Bloomberg Intelligence, wrote in a research note.

--With assistance from Toru Fujioka.

(Adds JSDA flow data.)