(Reuters) -Bank of America's profit rose about 10% in the third quarter as it joined rivals in earning more from interest payments by its customers, while investment banking and trading fared better than expected.

The second-largest U.S. bank on Tuesday posted net income of $7.8 billion, or 90 cents per share, sending its shares up 0.5% in premarket trading.

"We added clients and accounts across all lines of business," CEO Brian Moynihan said in a statement. "We did this in a healthy but slowing economy that saw U.S. consumer spending still ahead of last year but continuing to slow."

BofA's investment banking and trading units managed to outperform Wall Street expectations as they reported higher revenue, bucking an industry-wide slump.

Total investment banking fees rose 2% to $1.2 billion, while sales and trading revenue was up 8% to $4.4 billion in the third quarter.

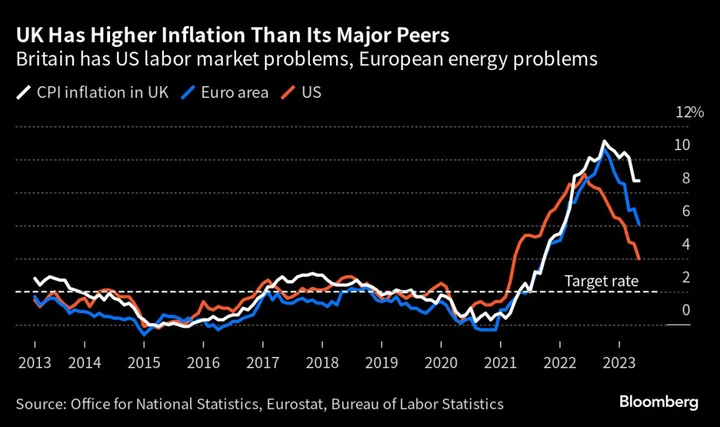

Meanwhile, lenders have seen their interest income swell as they had more room to charge higher rates on loans after the Federal Reserve raised borrowing costs in its fight against inflation.

Bank of America's net interest income (NII) rose 4% in the third quarter to $14.4 billion.

Lending giants JPMorgan Chase, Citigroup and Wells Fargo also reported a surge in NII on Friday and raised their forecasts for the key metric.

Interest income across the sector has also been supported by Americans who have healthy household finances and continue to spend money using their credit cards despite a looming economic slowdown.

Revenue at Bank of America's consumer banking unit rose 6% to $10.5 billion.

Net income applicable to common shareholders came in at $7.27 billion in the three months ended Sept. 30, compared with $6.58 billion a year earlier.

(Reporting by Manya Saini in Bengaluru and Nupur Ananad and Saeed Azhar in New York; Editing by Lananh Nguyen and Anil D'Silva)