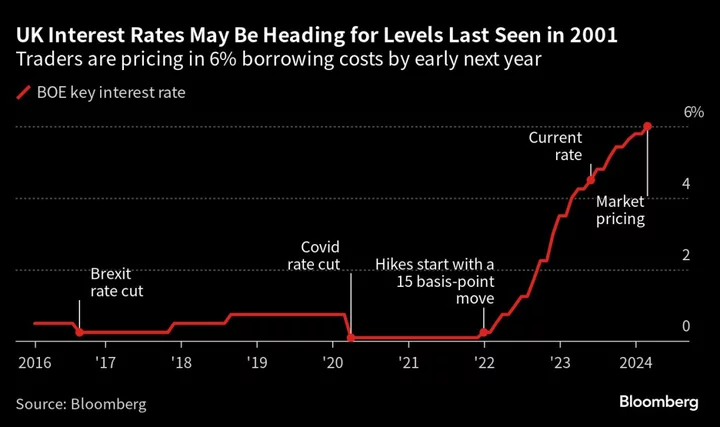

Traders are betting the Bank of England will have to accelerate the pace of interest-rate hikes to get a handle on inflationary pressures plaguing the economy.

Money markets shifted Wednesday on the back of a report showing inflation remained higher than expected for a fourth month. While the BOE on Thursday is expected to raise rates by 25 basis points to 4.75%, the risk of a larger half-point increase is growing, and is now fully priced by August.

Traders also lifted expectations for the terminal rate to 6%, which would be the highest since the turn of the century.

The UK has already been through the quickest tightening cycle in 40 years, and lifting the rates further would add to the pressure on borrowers, deal another blow to the housing market and raise questions about the outlook for the broader economy. But traders and analysts say more aggressive action is warranted regardless. The last time policymakers delivered a half-point hike was in February.

“Inflation is an elusive, wily and powerful foe especially when it builds up momentum, as it is now. There is a strong argument for a 50-basis point hike at tomorrow’s Bank of England’s meeting,” said Charles White Thomson, CEO at Saxo Capital Markets UK. “The Bank needs to take the initiative quickly. The risk for further policy failure is real and the stakes are getting increasingly high.”

Many households are already struggling because of the cost-of-living crisis, and an additional squeeze, plus worries about the economy, would add to the political headaches for Prime Minister Rishi Sunak. He says his focus is on lowering inflation. On Tuesday, Chancellor of the Exchequer Jeremy Hunt ruled out special mortgage support because it would only exacerbate price growth.

Expectations of even higher interest rates are fueling concern about the UK entering a recession, which is weighing on the pound. Despite a spike in yields, sterling fell as much as 0.5% to $1.2700 on Wednesday, leading losses among the Group-of-10 currencies.

“There’s an argument that if higher rates begin to pressure the UK’s economic growth, the pound will weaken,” said Ian Tew, head of G10 FX spot trading at Barclays Plc. “Feels like today’s higher inflation maybe the start of it.”

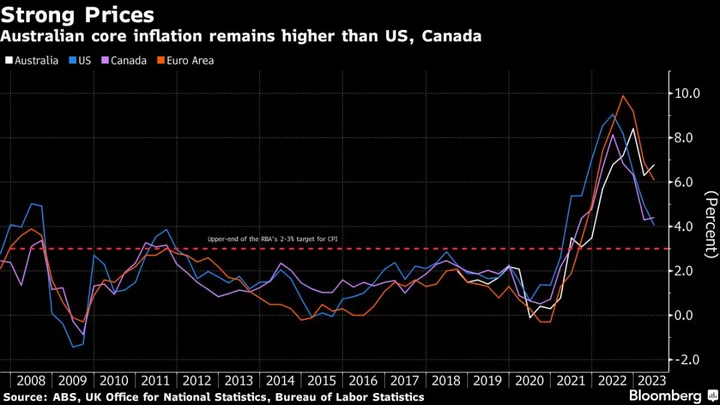

The last time traders were so hawkish on the outlook for interest rates was in September, when former prime minister Liz Truss shocked markets with huge spending plans. But sticky inflation and a tight labor market have led them to ramp up tightening bets once again, in contrast with their peers in the US and the euro zone, where policymakers are seen nearing the end of tightening cycles.

“The UK is in a situation that is worse than Europe and the US, the risk of inflation expectations de-anchoring is the highest in the developed world,” said Raphael Gallardo, chief economist at Carmignac Gestion SA. “The Bank of England has to keep hiking.”

The shifting outlook further inverted the UK yield curve, suggesting the market is more concerned over the growth outlook and expects rates to fall well into the future. The 10-year yield is now almost 70 basis points below its two-year peer, the most since 2000. Just a month ago, bets were on a terminal rate below 5%, a level still seen as the most likely by economists surveyed by Bloomberg.

“Higher inflation, higher growth. It’s not a good reason to own gilts,” said Kim Crawford, global rates portfolio manager at JPMorgan Asset Management, adding there’s a compelling case for a half-point hike on Thursday. “Recession is going to be required to get this inflation under control.”

--With assistance from Alice Gledhill, Greg Ritchie and Naomi Tajitsu.

(Adds pound move, comment in seventh, eighth paragraphs.)